There is a new report from the International Energy Agency. Gas accounted for 45 percent of the increase in total primary energy demand last year. Let’s talk more about how the states with cheap gas can fuel the global demand.

China is ground zero for the future of gas, accounting for 40 percent of global demand growth over the next half-decade. The main impetus for soaring gas consumption is to clean up horrific air pollution.

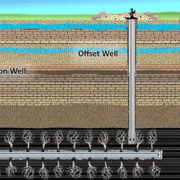

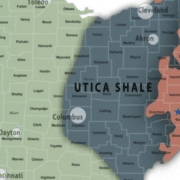

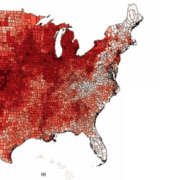

In the U.S., cheap gas has stoked demand, paving the way for billions of dollars’ worth of investment in petrochemical complexes and new gas-fired power plants. Cheap shale gas is killing coal, and new plants lock in future demand for gas. The same is true for nuclear power – as nuclear plants shut down, gas stands to benefit.

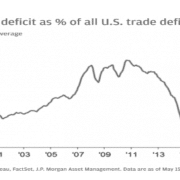

But a surge in natural gas production, in the U.S. but also elsewhere, is pushing up demand globally. The wave of LNG export terminals that have come online are also connecting more and more countries, making gas trade easier. The U.S. will overtake Qatar and Australia to become the largest LNG exporter in the world by 2024, the IEA said. Meanwhile, China will become the largest importer at the same time. That makes China’s import tariffs on U.S. LNG, which came in retaliation to Trump’s tariffs on China, particularly notable.

The market for LNG is facing a glut right now, but the IEA said that the surplus will flip into a deficit in the 2020s. The agency expects the next round of FIDs into new LNG export terminals to begin this year, after several years of paltry investment.

Read the full article here

Source: Oilprice.com

If you have further questions about the states with cheap gas topics, feel free to reach out to us here.