Why Are Oil Prices Rising and Should Investors Be Worried?

The Longer-Term Fundamentals

While oil prices rising, investors shouldn’t lose track of the longer-term fundamentals.

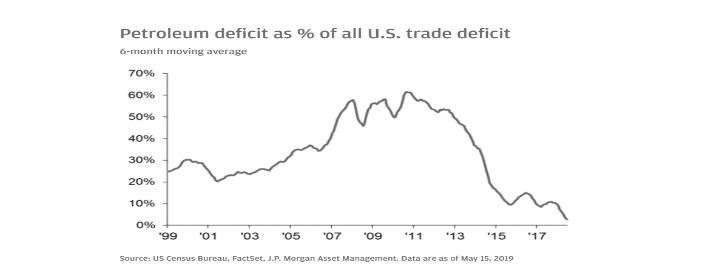

At its peak in 2011, 60% of the U.S. total trade deficit was due to petroleum. Last year U.S. oil production rose by 17% to a record high of 10.95 million barrels per day, in turn pushing down net petroleum imports to just 3% of the total trade deficit. With an estimated 39.2 billion barrels of proven crude oil reserves in the U.S., it is likely that the country will soon become entirely self-sufficient and even become a net exporter of oil to the rest of the world.

Reshape the Dynamics

The sheer magnitude of the United States’ proven crude oil reserves underscores the nation’s potential to reshape the dynamics of the global energy landscape. As exploration and drilling technologies continue to advance, these reserves are becoming increasingly accessible and economically viable to extract. This bodes well for the United States’ goal of achieving energy independence, as it reduces reliance on foreign oil imports and strengthens domestic energy security.

Carries Significant Economic and Geopolitical Implications

Moreover, the possibility of the United States transitioning from a net importer to a net exporter of oil carries significant economic and geopolitical implications. As a net exporter, the country would not only reap the economic benefits of increased oil production and exports but also enhance its position as an influential energy player on the global stage. The potential for increased revenue from oil exports can contribute to economic growth, job creation, and reduced trade deficits. Furthermore, the ability to supply oil to the international market could provide the United States with leverage and influence in diplomatic negotiations and geopolitical affairs.

The Potential Environmental and Sustainability Considerations

However, it is important to consider the potential environmental and sustainability considerations associated with increased oil production. While the development of these reserves may provide short-term economic gains, it is essential to prioritize responsible and sustainable extraction practices to minimize adverse environmental impacts. Striking a balance between economic growth, energy security, and environmental stewardship will be crucial as the United States navigates its path towards self-sufficiency and potential oil exportation.

In Conclusion

The United States’ significant proven crude oil reserves offer a promising outlook for the nation’s energy future. The potential for achieving energy self-sufficiency and becoming a net exporter of oil presents numerous economic opportunities and geopolitical advantages. However, it is imperative that these developments are accompanied by responsible and sustainable extraction practices to mitigate environmental concerns. By striking a balance between economic growth and environmental stewardship, the United States can harness the full potential of its oil reserves while ensuring a sustainable energy future for generations to come.

Read the full article here

Source: ETF Trends

If you have further questions related to the Oil Prices Rising topic, feel free to reach out to us here.

Leave a Reply

Want to join the discussion?Feel free to contribute!