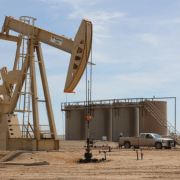

Gas & Oil companies are swimming in so much cash that they’re cutting back on borrowing at a faster pace

Demand for Loans

Last year, the demand for loans from Gas & Oil companies or fossil-fuel companies fell 6% year-on-year and that followed a decline of 1% in 2022.

From a climate perspective, this may sound like good news because the drop in bank lending to oil, gas and coal companies should mean less investment and less production over time.

The reality, however, is that oil and gas companies don’t need a lot of loans because they’re generating so much money these days from their underlying businesses, said Andrew John Stevenson, senior analyst at Bloomberg Intelligence. And that trend is likely to continue through the end of the decade, he said.

Its Fair Share of Ups and Downs

The oil and gas industry has seen its fair share of ups and downs in recent years, marked by cycles of booms and busts. However, the current landscape seems to be favoring a more prosperous outlook, with companies reporting healthy balance sheets and increased cash flow.

This financial stability can largely be attributed to the upward trend in oil prices, which have been driven by a combination of factors such as strong global demand and coordinated production cuts by OPEC and its allies under the OPEC+ agreement.

A Much-Needed Boost

The resurgence in oil prices has provided a much-needed boost to companies within the industry, enabling them to capitalize on the improved market conditions. With a steady stream of revenue coming in, many firms are now in a stronger position to invest in exploration, production, and technological advancements.

This influx of capital not only benefits the companies themselves but also has a ripple effect on the broader economy, as it creates jobs, drives innovation, and contributes to overall economic growth. As the industry continues to navigate through this period of relative stability, it will be interesting to see how companies leverage their newfound financial strength to drive long-term growth and sustainability.

Click here to read the full article

Source: FORTUNE

—

If you have any questions or thoughts about the topic, feel free to contact us here or leave a comment below.

Leave a Reply

Want to join the discussion?Feel free to contribute!