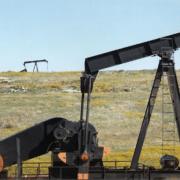

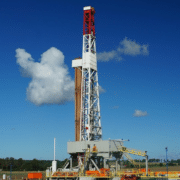

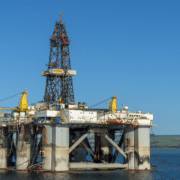

When you think of giant oil fields you probably conjure up an image of vast areas of land or sea suitable for digging. However, Los Angeles demonstrates that oil extraction can take place right under our feet, producing as much as 100 million barrels every year. Compared to other major oil sites across the world, L.A. disguises oil diggers, sprawled across the city, as towers and buildings, so as not to look out of place. Six-story buildings and painted towers have been constructed across the city as facades to big oil diggers, extracting the black gold out of sight of daily commuters and tourists. Let’s talk more about oil boom.

With approximately 5,000 urban oil wells and 70 functioning oil fields, L.A. is a giant producer that no one talks about. There are a few other locations where extraction projects are taking place right in the center of the city, next to schools, businesses, and hospitals. Except for long-standing residents who have learned of the digging, few know about the urban oil production happening right on their doorstep.

Click here to read the full article.

Source: Oil Price

If you have further questions about oil boom, feel free to reach out to us here.