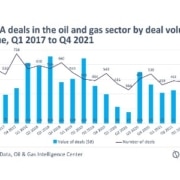

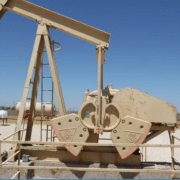

More oil and gas pipelines are coming to southeast New Mexico. This is as operators in the Permian Basin seek to up fossil fuel production in response to growing demand. More people are now expecting an oil and gas surge.

Odessa, Texas-based Saulsbury Industries announced Feb. 16 it received multiple contracts to build about 16.5 miles of pipelines in the region, in the western Delaware sub-basin of the Permian which also spans east into West Texas.

The work will be on the New Mexico side of the border, likely be directed out of the company’s field office in Carlsbad.

Saulsbury also provides engineering, procurement, and fabrication services to oilfield operators.

Travis Zatopek, Saulsbury director of operations for field services said the project will allow the company to capitalize on growth in the oil and gas industry in 2022.

“We are excited to see the continued growth of the Field Services operating group,” Zatopek said. “This is an excellent start to attaining our goals for 2022 and showcasing Saulsbury’s broad capabilities within the industry.”

Click here to read the full article

Source: Carlsbad Current-Argus