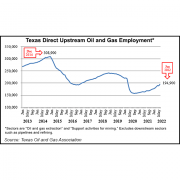

“As expected, the dip in May upstream employment appeared to be an anomaly. June numbers reflect continued demand for talent and increasing exploration and production activities in the Texas oil and natural gas industry,” said TIPRO’s President Ed Longanecker.

TIPRO, which obtains its employment data from the U.S. Bureau of Labor Statistics, also noted that Texas’ June upstream job count represents a 31,000 year/year increase. The oilfield services (OFS) sector accounted for 22,700 of those new jobs. Moreover, with the remaining 8,300 ascribed to oil and gas extraction, the trade group added.

The 31,000-job gain occurred in tandem with a 55% year/year increase in statewide drilling permits issued by the Railroad Commission of Texas.

TIPRO reported that the Houston metropolitan area, Texas’ largest region for oil and gas employment, added 2,000 upstream jobs from May to June to hit 67,000 direct positions.

The trade group noted the June Houston metro upstream job count reflects a 10,000-position year/year increase. It is with 5,600 of those jobs in OFS and 4,400 in extraction-related roles.

Click here to read the full article

Source: Natural Gas Intelligence

If you have further questions about the topic of Texas Upstream Natural Gas, feel free to contact us here.