When it comes to investing in residential real estate, one of the fundamental concepts to grasp is fee simple ownership. This form of ownership is prevalent in the real estate market and carries significant implications for both buyers and sellers. In this comprehensive guide, we will delve into the intricacies of fee simple ownership, evaluating its characteristics, advantages, and potential drawbacks.

Introduction to Evaluating Fee Simple Ownership

Fee simple ownership represents the most complete form of ownership recognized by law. In essence, it grants the owner absolute ownership rights over the property, including the land and any structures on it. This type of ownership is distinguished by its perpetual nature, meaning that the owner has the right to possess, use, and dispose of the property indefinitely, subject only to applicable laws and regulations.

Characteristics of Evaluating Fee Simple Ownership

One of the key features of fee simple ownership is the absence of any conditions or limitations imposed on the owner’s rights. Unlike other forms of ownership, such as leasehold or conditional estates, fee simple ownership confers absolute control over the property. This means that the owner has the freedom to make decisions regarding its use, development, and transfer without seeking permission from any other party.

Moreover, fee simple ownership is typically inheritable, allowing owners to pass their property down to their heirs through wills or intestate succession. This aspect ensures the continuity of ownership across generations, contributing to the long-term stability of residential real estate investments.

Advantages of Evaluating Fee Simple Ownership

The advantages of fee simple ownership are manifold, making it an attractive option for investors and homeowners alike. Firstly, owning property in fee simple provides a sense of security and autonomy, as the owner has full control over their investment without being subject to the terms of a lease or other encumbrances.

Additionally, fee simple ownership allows for greater flexibility in terms of property usage and modification. Owners can undertake renovations, expansions, or other improvements without seeking approval from landlords or third parties, thereby enhancing the value and functionality of their investment.

Furthermore, fee simple ownership affords owners the opportunity to benefit from appreciation in property value over time. As the real estate market fluctuates and demand for residential properties increases, owners stand to realize significant returns on their investment through capital appreciation.

Considerations for Prospective Buyers

For prospective buyers, evaluating fee simple ownership entails careful consideration of various factors to ensure a sound investment decision. Firstly, it is essential to conduct thorough due diligence regarding the property’s title and legal status to confirm the existence of fee simple ownership and identify any potential encumbrances or restrictions.

Moreover, buyers should assess the property’s location, market dynamics, and potential for future growth to gauge its long-term appreciation potential. Factors such as proximity to amenities, schools, transportation hubs, and employment centers can significantly influence the desirability and value of residential real estate.

Additionally, buyers should evaluate their financial situation and consider factors such as mortgage financing, property taxes, maintenance costs, and potential rental income if they intend to lease the property. Calculating the overall affordability and return on investment is crucial in determining the feasibility of acquiring property in fee simple ownership.

Potential Drawbacks and Risks

While fee simple ownership offers numerous benefits, it is not without its drawbacks and risks. One potential downside is the financial responsibility associated with property ownership, including mortgage payments, property taxes, insurance premiums, and maintenance costs. Failure to meet these obligations can lead to financial strain or even foreclosure.

Furthermore, fee simple ownership exposes owners to various liabilities, including legal disputes, property damage, and liability claims from tenants or third parties. Adequate insurance coverage and risk management strategies are essential to mitigate these risks and protect owners from potential losses.

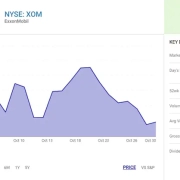

Additionally, fluctuations in the real estate market can impact the value of properties held in fee simple ownership, potentially leading to depreciation or stagnation in property values. Economic downturns, changes in market conditions, and shifts in consumer preferences can all influence the demand for residential real estate and affect its long-term viability as an investment.

In conclusion, fee simple ownership is a cornerstone of residential real estate investment, offering owners unparalleled control, autonomy, and potential for long-term appreciation. By understanding the characteristics, advantages, and considerations associated with fee simple ownership, investors and homeowners can make informed decisions and navigate the complexities of the real estate market effectively. Whether purchasing a primary residence, rental property, or investment portfolio, fee simple ownership remains a preferred choice for those seeking to build wealth and secure their financial future through real estate.

If you have further questions related to the Evaluating Fee Simple topic, feel free to reach out to us here