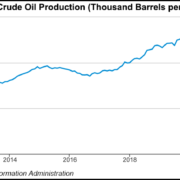

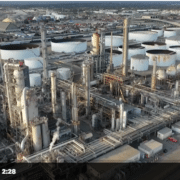

OKLAHOMA CITY – The price for gasoline is up nationwide as American consumers feel the squeeze from global sanctions against Russia. Basically, oil and gas production is affected.

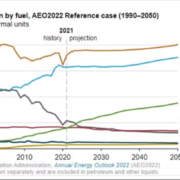

Last month, Oklahoma Gov. Kevin Stitt wrote a letter to President Joe Biden days after Russia invaded Ukraine, urging the administration to embrace domestic oil and gas production and halt the importation of Russian energy products. The first-term Republican demanded that Biden relies on energy-producing states like Oklahoma to step up domestic production, a call echoed by other state leaders like Sen. Jim Inhofe.

“Every administration since 1973, Republican and Democrat, prioritized American energy independence – until yours,” Stitt wrote. “The recent events in Ukraine are yet another example of why we should be selling energy. Mainly to our friends and avoid buying it from our enemies.”

The U.S. is not a major buyer of Russian oil, nor does it import any gas from the country. Still, in early March, the U.S. banned the import of Russian oil, liquefied natural gas and coal, citing the nation’s “strong domestic energy infrastructure” as a reason why the country could take the step to reduce its dependence on Russian energy.

Click here to read the full article

Source: PBS

If you have further questions about the topic, feel free to contact us here.