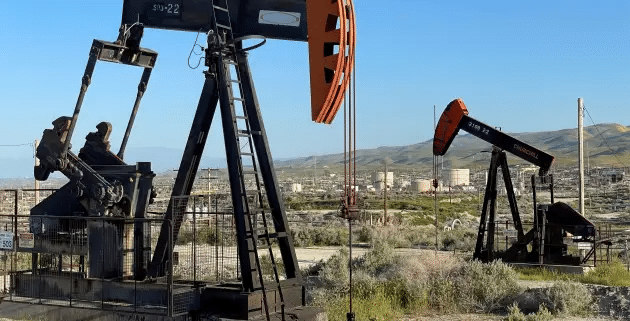

Oil Prices Gain More Than 1% as Investors Eye U.S. Crude Supplies

Oil prices gain on Tuesday as investors weighed a possible tightening of U.S. crude supplies against weaker-than-expected Chinese economic growth.

Both benchmark contracts had fallen more than 1.5% on Monday following lackluster economic data from China, the world’s largest oil importer, as well as the partial restart of some Libyan oilfields.

Brent crude was up 1.3% to $79.52 a barrel, while U.S. West Texas Intermediate (WTI) crude rose 1.6% to $75.34 a barrel in relatively muted trading, with the contract set to expire on Thursday.

“With the manufacturing sector languishing and inflation showing encouraging signs of slowing, the widely-anticipated July Federal Reserve interest rate hike may be the last,” analysts at Bank ING said in a note.

Higher interest rates increase borrowing costs and can slow economic growth and reduce oil demand.

After posting sluggish gross domestic product data earlier in the week, China’s top economic planner pledged it would roll out policies to “restore and expand” consumption without delay.

Energy traders expect “the oil market will remain tight as Russian shipments drop and as China prepares to provide more support to households,” said Edward Moya, senior market analyst at data and analytics firm OANDA.

Click here to read the full article

Source: CNBC

If you have further questions about the topic related to Oil Prices Gain, feel free to contact us here.

Leave a Reply

Want to join the discussion?Feel free to contribute!