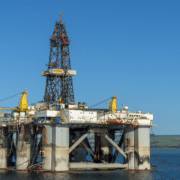

Once on the margin of the margins, calls for the nationalization of US fossil fuel interests are growing. Before the COVID-19 pandemic, the basic argument was this: nationalization could expedite the phasing out of fossil fuels in order to reach climate targets while ensuring a “just transition” for workers in coal, oil, and gas. Nationalization would also remove the toxic political influence of “Big Oil” and other large fossil fuel corporations. The legal architecture for nationalization exists — principally via “eminent domain” — and should be used.

But the case for nationalization has gotten stronger in recent months. The share values of large fossil fuel companies have tanked, so this is a good time for the federal government to buy. In April 2020, one source estimated that a 100 percent government buyout of the entire sector would cost $700 billion, and a 51 percent stake in each of the major companies would, of course, be considerably less. However, in May 2020 stock prices rose by a third or so based on expectations of a fairly rapid restoration of demand.

Click here to read the full article.

Source: Jacobin Mag