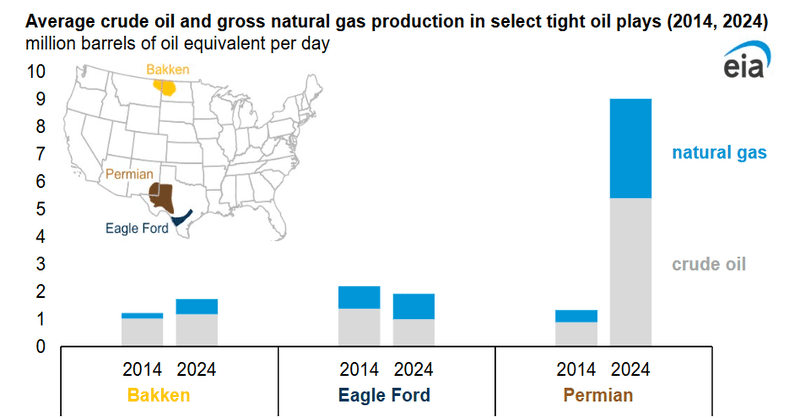

Natural gas produced from the three largest tight oil-producing plays in the United States has increased in the last decade. Share of Natural gas comprised 40% of total production from the Bakken, the Eagle Ford, and the Permian compared with 29% in 2014.

Combined crude oil and natural gas production from tight oil plays has seen remarkable growth. It has more than doubled over the past decade. This substantial increase can be largely attributed to the advancements in extraction technologies. Notably hydraulic fracturing and commonly referred to as fracking. It is a horizontal drilling technique. These innovations have revolutionized the energy sector by enabling producers to access previously unreachable reserves of crude oil and natural gas trapped in tight formations. As a result, the landscape of energy production in the United States and globally has shifted significantly, with an expanding array of resources becoming available for both domestic consumption and international export.

Production of Natural Gas

In particular, the production of associated natural gas, which is derived from oil wells primarily producing crude oil, has outpaced the growth of crude oil output during this period. Specifically, natural gas production from these tight oil plays has more than tripled, reflecting a remarkable increase of 22 billion cubic feet per day (Bcf/d). In contrast, crude oil production has more than doubled, resulting in an additional 4 million barrels per day (b/d). This dynamic shift underscores the interlinked nature of oil and gas production and highlights the growing importance of natural gas as a critical component of the energy portfolio. As market dynamics evolve, stakeholders within the industry must adapt to these changes, balancing the extraction of both resources while considering environmental impacts and regulatory frameworks.

Click here to read the full article

Source: EIA

—

Do you have any questions or thoughts about the topic related to the share of natural gas? Feel free to contact us here or leave a comment below.