Report: America has up to 227 years of oil & gas remaining

Latest Oil & Gas Remaining or The Annual North American Energy Inventory

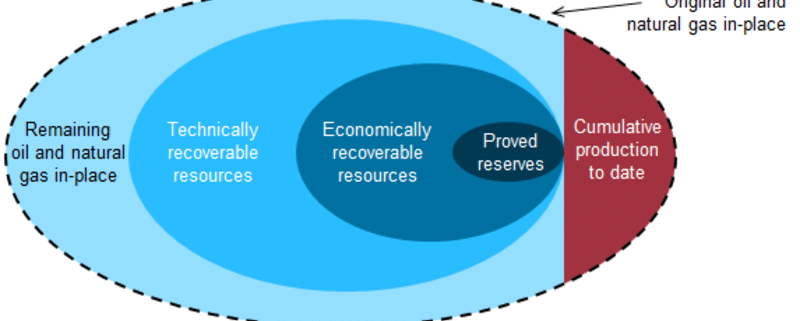

The Institute for Energy Research (IER), a free market think tank focusing on energy. Has just released its latest oil & gas remaining or the annual North American Energy Inventory. The report shows that North America has 1.66 trillion barrels of technically recoverable resources. And at current rates of consumption, the report calculates that it would take 227 years to deplete it all.

The report provides valuable insights into the current state of fossil fuel reserves. Particularly focusing on coal – renowned for being one of the most abundant fossil fuels available. It highlights that the proved reserves of coal stand. At a level that could potentially meet the global demand for over four centuries at the consumption rates witnessed in 2022.

The Significant Supply of Coal and its Enduring Presence

This substantial figure underscores the significant supply of coal and its enduring presence in the global energy mix. Contrary to the notion of imminent depletions such as “peak oil” or “peak gas”. The report challenges these concerns when it comes to coal. Urging against heeding the radicalized left’s rhetoric that often perpetuates such fear-mongering narratives.

The extensive longevity of coal reserves as indicated in the report serves as a compelling reminder of the need for a balanced and evidence-based approach to discussions around fossil fuels. By debunking the myth of an impending “peak coal,” the report encourages a more nuanced understanding of the energy landscape, emphasizing the importance of rational analysis over sensationalized claims.

In a time where energy security and sustainability are paramount considerations. The enduring reserve capacity of coal presents an opportunity for thoughtful consideration and strategic planning in meeting the world’s energy needs for the foreseeable future.

Click here to read the full article

Source: Marcellus Drilling News

—

If you have any questions or thoughts about the Oil & Gas Remaining Topic, feel free to contact us here or leave a comment below.

Leave a Reply

Want to join the discussion?Feel free to contribute!