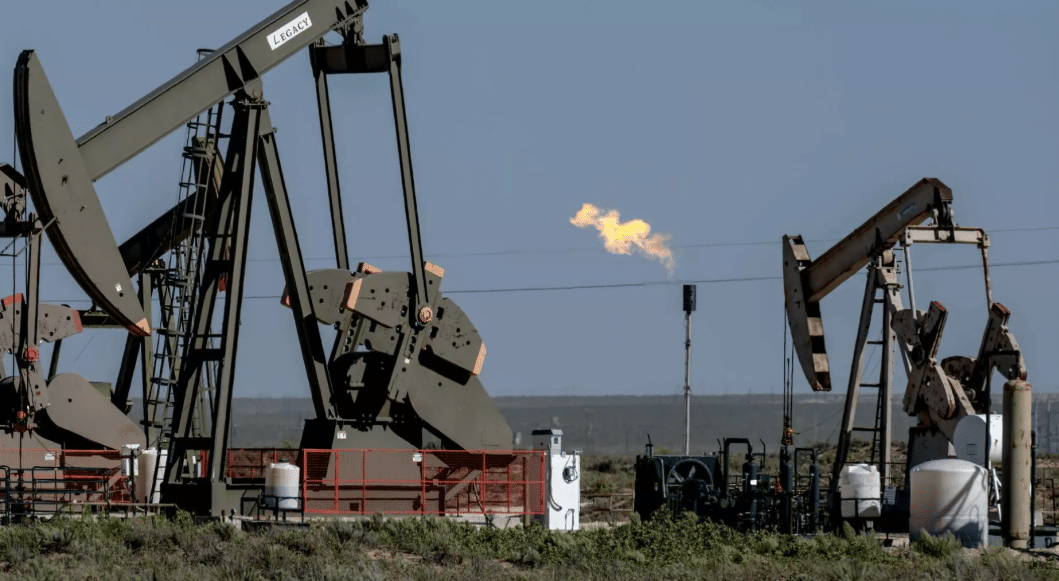

An opinion column from Tracee Bentley, president and CEO of the Permian Strategic Partnership (PSP), argues that sustaining Permian Basin growth depends on continued investment in the southeast New Mexico communities that support energy development. Bentley writes that if the Permian Basin were a country, it would rank among the world’s top oil producers, and that the region could account for 50% of U.S. oil production by 2030. She says energy companies formed the PSP to collaborate on regional priorities, reporting more than $214 million in direct spending over six years and over $2.3 billion in leveraged collaborative investments.

The piece focuses on workforce development and public services needed to support long-term activity, citing an estimated need for nearly 186,000 additional workers by 2040. Bentley highlights PSP support for career and technical programs in Hobbs, Artesia, and at Southeast New Mexico College, including $15 million in funding this year. She also points to expanded commercial driver training at New Mexico Junior College (with an estimated need for 7,000 new drivers by 2040), regional first-responder training with Eddy County Fire and Rescue, and a $325,000 investment for five cardiac monitors for Carlsbad Fire Department units. Bentley adds that the Permian region represents 9.2% of New Mexico’s population but produces 25.9% of the state’s private-sector GDP, framing these efforts as support for a durable economic base tied to the Permian Basin and ongoing oil and gas royalties.

Source: Albuquerque Journal

Read the full original article here