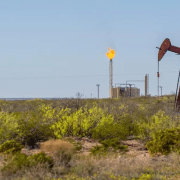

Crude Oil prices climb for third straight week today, the third in a row, as Israel and Iran continued to bomb each other with no sign of willingness on either side to switch to diplomacy.

At the time of writing, Brent crude was trading at $77.04 per barrel, with West Texas Intermediate at $75.67 per barrel as the latest war in the Middle East entered its second week. The benchmarks dipped slightly from Thursday.

The hostilities have pushed tanker rates sky high, along with vessel insurance, with many shippers choosing to avoid the Strait of Hormuz altogether, not least because the deployment of electronic interference warfare that scrambles the navigational systems of ships, increasing the risk of an accident.

Click here to read the full article

Source: Oil Price

—

Do you have any questions or thoughts about the topic related to Oil prices climb for third straight week? Feel free to contact us here or leave a comment below.