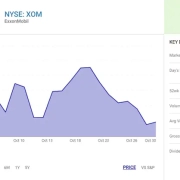

Oil jumps on prices almost 7% on Friday to multi-month highs after Israel launched strikes against Iran. It is sparking Iranian retaliation and raising worries about a disruption in Middle East oil supplies.

Brent crude futures were up $4.57, or around 6.59%, to $73.93 a barrel at 1352 GMT. This is after hitting an intraday high of $78.50, the highest since January 27.

U.S. West Texas Intermediate crude was up $4.53, or 6.66%, at $72.57. It is touching its highest since January 21 at $77.62 earlier in the session.

Friday’s gains were the largest intraday moves for both contracts since 2022, after Russia’s invasion of Ukraine caused a spike in energy prices.

Israel said it had targeted Iran’s nuclear facilities, ballistic missile factories and military commanders on Friday at the start of what it warned would be a prolonged operation to prevent Tehran from building an atomic weapon. Iran has promised a harsh response.

U.S. President Donald Trump urged Iran to make a deal over its nuclear programme, to put an end to the “next already planned attacks.”

The National Iranian Oil Refining and Distribution Company said oil refining and storage facilities had not been damaged and continued to operate.

Click here to read the full article

Source: Oil & Gas 360

—

Do you have any questions or thoughts about the topic as Oil jumps? Feel free to contact us here or leave a comment below.