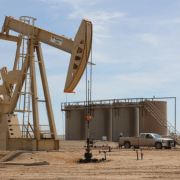

Occidental to buy Permian oil producer CrownRock in $12-billion deal

Permian Oil and Gas Producer CrownRock

Occidental Petroleum will buy Permian oil and gas producer CrownRock. For cash and stock in a deal valued at around $12 billion, including debt, Oxy said on Monday. Announcing the latest large acquisition in the U.S. oil industry.

Reports of a potential Occidental- CrownRock transaction will appear at the end of last month. When the Wall Street Journal announce that a deal would be estimate at more than $10 billion including debt.

Occidental confirmed those reports today with the news that it has entered into a purchase agreement to buy CrownRock, whose over 94,000 net acres of premium stacked pay assets and supporting infrastructure “are well positioned alongside Occidental’s legacy Midland Basin business.”

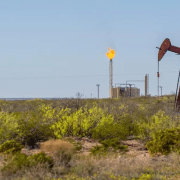

170,000 Barrels of Oil Equivalent Per Day

The acquisition will boost Occidental’s premier Permian portfolio. With the addition of around 170,000 barrels of oil equivalent per day (boed) of high-margin. Lower-decline unconventional production in 2024, as well as approximately 1,700 undeveloped locations.

It’s also look forward to deliver increased free cash flow on a diluted share basis, including $1 billion in the first year based on $70 per barrel WTI price.

The transaction is looking forward to close in the first quarter of 2024, subject to customary closing conditions and the receipt of regulatory approvals.

Click here to read the full article

Source: Oil Price

—

If you have any questions or thoughts about the topic, feel free to contact us here or leave a comment below.

Leave a Reply

Want to join the discussion?Feel free to contribute!