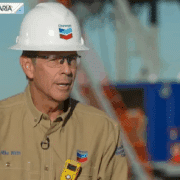

In an exclusive conversation with FOX Business’ Maria Bartiromo during a tour of the Permian Basin, Chevron CEO Mike Wirth said America’s vast energy resources are not just an economic advantage – but also a matter of national defense – while praising President Donald Trump’s energy initiatives.

Wirth said, “Energy security and national security are linked,” in a preview of his interview on “Sunday Morning Futures,” which will air in full on “Mornings with Maria” Monday.

“He continued that an abundance of natural resources blesses the U.S.” “And we now have an administration that wants to see the energy industry invest in those resources to make sure that America’s energy strength translates into economic strength and competitiveness and, importantly, security.”

Click here to read the full article

Source: Fox Business

—

Do you have any questions or thoughts about the topic related to Chevron CEO? Feel free to contact us here or leave a comment below.