Wyoming’s economy continued to rebound in the third quarter of 2021, but its growth has slowed down. And thanks to the highest prices of oil and natural gas seen in several years, the mining industry had a relatively good quarter.

On the whole, Wyoming recorded about 6,800 or 2.4% more payroll jobs in the third quarter of 2021 compared to 2020. Leisure and hospitality led this growth with 4,300 more jobs, an 11.9% increase, during that time.

Even with that growth, Wyoming trailed behind the nation as a whole, which saw job growth of 4.6%

On the bright side, the state’s top industry, mining, saw moderate growth, increasing 5.9% in the third quarter thanks to a rebound in oil and natural gas activities. It was the first year-over-year increase for mining since the second quarter of 2019, said Wenlin Liu, chief economist with Wyoming Division of Economic Analysis, in a press release.

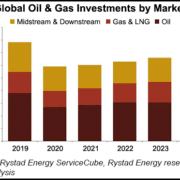

In the third quarter, $185.4 million was generated in mineral severance taxes. That was about a 26% increase from 2020, and the highest quarterly amount since the fourth quarter of 2014.

Liu noted that it was due to oil and natural gas, which saw their highest prices since 2014 and 2008, respectively.

Total taxable sales grew by just 1.5% in the third quarter of 2021. Liu attributed this weak performance to the fading activities in wind power construction. Otherwise, both leisure and hospitality and retail trade had strong expansions, passing 2020 levels by double digits.

In Campbell County, taxable sales grew by 18%, the sixth-highest in the state.

Click here to read the full article

Source: The Sheridan Press