Energies Media reports that Energy Transfer is advancing the Hugh Brinson Pipeline, a new 442-mile project designed to move natural gas from processing facilities in Texas into existing pipeline infrastructure south of the Dallas–Fort Worth area. The company said the pipeline remains on schedule for completion in late 2026, with initial deliveries expected toward the end of 2026.

The article notes that the project is part of a broader buildout of Permian Basin natural gas takeaway capacity aimed at serving growing demand from Texas markets and other downstream customers. Energy Transfer also said the project has progressed through required regulatory processes and that much of the route follows an existing pipeline right-of-way to help limit construction impacts. For additional context on the wider trend, see Ranger coverage on the Permian pipeline buildout and recent capacity additions like the Matterhorn Express expansion.

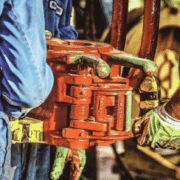

Energies Media adds that construction began in 2025 and the project is expected to support local manufacturing of steel components. During construction, Energy Transfer said the effort provided nearly 3,100 jobs, with an additional 34 full-time roles associated with the project.

Source: Energies Media

Read the full original article here