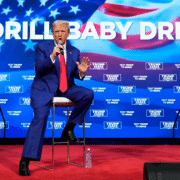

The U.S. Administration will fill up fast the Strategic Petroleum Reserve (SPR) as oil prices climb, President Donald Trump said at an investment conference in Miami.

“We’ll fill it up fast, but it’s at the lowest level. When we made the transition, it was at the lowest level in history, ever recorded,” President Trump said.

“They put it all out because they thought they could keep gasoline prices down a little bit, just go past the election, and after that, they didn’t care,” the President added, criticizing Joe Biden’s administration for failing to curb the hikes in gasoline prices.

The government needs to refill the SPR because the strategic reserve plays a critical role in stabilizing the U.S. market during global supply disruptions.

The Biden administration released more than 180 million barrels of oil from the SPR starting in 2021, amid high gasoline prices. The Department of Treasury claims that these releases, along with coordinated international efforts, helped reduce gasoline prices by up to 40 cents per gallon in 2022.

SPR – Oil Prices Climb

The SPR currently houses 395 million barrels of crude—a figure that is about 250 million barrels less than oil in the SPR at the beginning of Joe Biden’s term in office. The Reserve’s total capacity is 714 million barrels of crude.

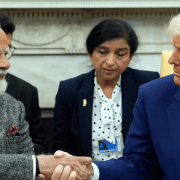

Also this week, President Trump promised tax cuts for oil and gas producers.

President Trump will enlist the help of Republicans in Congress to reduce the debt burden on households and companies, notably oil and gas producers, whom he will allow to expense 100% of capital spending.

Oil drillers, however, have signaled they had no immediate plans to boost production any further, unless global prices improved enough to motivate such a move.

Click here to read the full article

Source: Oil Price

—

If you have any questions or thoughts about the topic on Oil prices climb, feel free to contact us here or leave a comment below.