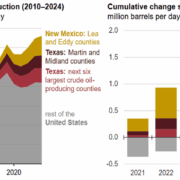

US crude oil production from onshore federal lands hit a record 1.7 million barrels per day (bpd) in 2024, according to the EIA and the Department of the Interior. That’s a sixfold jump since 2008—far outpacing the broader rise in national crude output, which nearly tripled to 13.2 million bpd over the same period. The driver? An explosion of activity in New Mexico’s portion of the Permian Basin, where leasing, permitting, and drilling have surged in recent years.

From FY2020 through FY2023, New Mexico accounted for the majority of federal land drilling permits approved and well bores started. The state has quietly become the epicenter of the federal onshore oil boom, combining geological riches with favorable permitting conditions and existing infrastructure.

Click here to read the full article

Source: Oil & Gas 360

—

Do you have any questions or thoughts about the topic related to US onshore oil production? Feel free to contact us here or leave a comment below.