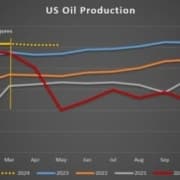

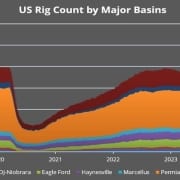

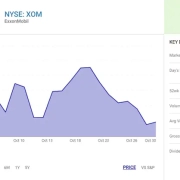

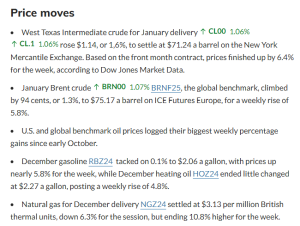

Oil futures settled higher on Friday, with the U.S. crude benchmark up by more than 6% for the week as traders continued to monitor escalating tensions between Ukraine and Russia, which is among the world’s biggest oil producers. Let’s talk more about oil prices score.

Still, downbeat economic data from Europe fed concerns over a potential slowdown in energy demand, as European business activity sank to a 10-month low, helping to limit gains for oil and keep WTI and Brent prices down year to date.

Click here to read the full article

Source: Market Watch

—

If you have any questions or thoughts about the topic oil prices score, feel free to contact us here or leave a comment below.