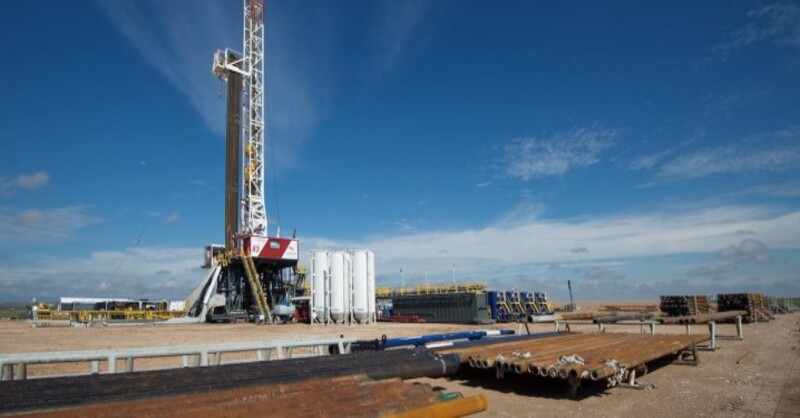

The total number of active drilling rigs for oil and gas in the United States rose this week, according to new data that Baker Hughes published on Friday. Ready to learn more about US Oil Drilling Activity?

The total rig count rose by 1 this week to 586, compared to 622 rigs this same time last year.

The number of oil rigs rose by 2 this week to 481—down by 20 compared to this time last year. The number of gas rigs fell by 1 this week to 101, a loss of 16 active gas rigs from this time last year. Miscellaneous rigs stayed the same at 4.

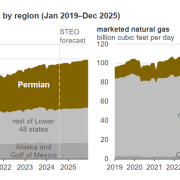

Meanwhile, U.S. crude oil production rose in the week ending October 4, according to weekly estimates published by the Energy Information Administration (EIA). Current weekly oil production in the United States, according to the EIA, has resumed its all-time high at 13.4 million bpd.

Primary Vision’s Frac Spread Count, an estimate of the number of crews completing wells that are unfinished, fell in the week ending October 4, from 238 back to 236.

Drilling activity in the Permian stayed the same this week at 304—a figure that is just 7 fewer than this same time last year. The count in the Eagle Ford rose by 1 this week to 49. Rigs in the Eagle Ford are now 2 below where they were this time last year.

Click here to read the full article

Source: Oil Price

—

Do you have any questions or thoughts about the topic related to US Oil Drilling Activity? Feel free to contact us here or leave a comment below.