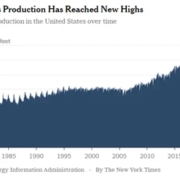

U.S. energy firms this week added oil and natural gas rigs for a fourth week in a row for the first time since February, energy services firm Baker Hughes said in its closely followed report on Friday. Learn more about US oil US oil and gas rig count.

The oil and gas rig count, an early indicator of future output, rose by seven to 549 in the week to September 26, its highest since June.

Despite this week’s rig increase, Baker Hughes said the total count was still down 38 rigs, or 6% below this time last year.

Baker Hughes said oil rigs rose by six to 424 this week, their highest since July, while gas rigs fell by one to 117, their lowest since July.

Click here to read the full article

Source: yahoo!finance

—

Do you have any questions or thoughts about the topic? Feel free to contact us here or leave a comment below.