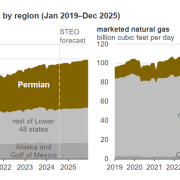

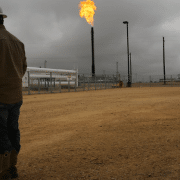

Despite the Biden-Harris administration’s stated objectives to phase out oil and gas production. This is in favor of more sustainable energy sources, recent developments in the Permian and Bakken basins illustrate a contrasting reality. Record oil production is happenning now. These regions, which are pivotal to the U.S. energy landscape, are currently experiencing oil and gas production rates that have not been witnessed in over 13 years. This resurgence in output underscores the complexities of transitioning to greener energy, as it appears that the demand for fossil fuels remains robust. Notably, the Macquarie Group has revised its forecasts, suggesting that U.S. crude production may outpace many analysts’ expectations, indicating a more resilient oil market than previously anticipated.

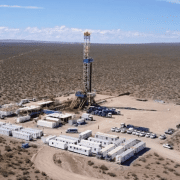

In the Midland Basin, which spans parts of Texas and New Mexico, operators—including several firms based in Oklahoma—have significantly intensified drilling activities. According to a report by Bloomberg, these companies drilled an impressive average of 47 miles of horizontal lateral wells during the year ending in June, marking a record high not seen since 2011.

The Ongoing Innovation

This remarkable achievement not only underscores the ongoing innovation and efficiency improvements within the energy sector but also provokes critical questions regarding the long-term implications for energy policy and environmental considerations. As production levels continue to rise, it is essential to recognize the transformative impact this growth may have on both local and global markets. Stakeholders—including policymakers, industry leaders, and environmental advocates—must engage in comprehensive dialogues to understand how these advancements can be strategically leveraged to meet increasing energy demands. Furthermore, this raises important inquiries about the sustainability of such production methods and the potential for technological solutions to mitigate adverse effects.

As the industry evolves, the challenge lies in navigating the intricate balance between satisfying immediate energy needs and committing to sustainable practices that align with broader climate goals. This includes exploring renewable energy sources, enhancing energy efficiency, and implementing responsible resource management. By fostering collaboration among diverse stakeholders, the sector can create a framework that not only prioritizes energy security but also promotes environmental stewardship. Therefore, the ongoing dialogue surrounding these developments is crucial, as it will determine the trajectory of energy policies and practices in the years to come, ultimately shaping a sustainable future for generations.

Click here to read the full article

Source: OK Energy Today

—

If you have any questions or thoughts about the topic of record oil production, feel free to contact us here or leave a comment below.