On Thursday, oil prices broadly stable amid ongoing uncertainties related to conflicts in the Middle East and reports indicating that North Korean troops may be poised to assist Russia in Ukraine, keeping traders cautious as the U.S. presidential election approaches.

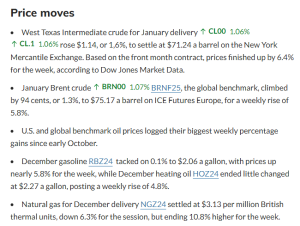

By 1318 GMT, Brent crude futures had increased by 46 cents, or 0.6%, reaching $75.42 per barrel, while U.S. West Texas Intermediate crude futures rose by 39 cents, also a 0.6% gain, to settle at $71.16.

This week, oil prices have risen approximately 3% following a decline of over 7% the previous week, attributed to a perceived de-escalation of tensions in the Middle East, alongside concerns regarding oversupply and sluggish demand.

Tamas Varga, an analyst at oil brokerage PVM, noted, “The interplay of economic uncertainty, a loose oil supply landscape, and potential disruptions related to conflict will likely prevent a definitive trend in oil prices in the near term, with medium-term risks leaning towards a downward trajectory.”

On Wednesday, the U.S. government reported evidence suggesting that North Korea has dispatched 3,000 troops to Russia, potentially for deployment in Ukraine, a development that could significantly intensify Russia’s conflict with Ukraine.

Intensifying Hostilities

In the Middle East, intensified hostilities between Israel and Hezbollah raised concerns regarding supply disruptions, while airstrikes carried out by Israel reportedly targeted the Syrian capital, Damascus, early Thursday.

Simultaneously, Washington is actively advocating for a resolution between Israel and Iranian-backed factions, including Hezbollah and Hamas, ahead of the U.S. presidential election on November 5, an event that could influence American foreign policy in the region as well as oil market dynamics.

Kelvin Wong, a senior market analyst at OANDA, observed, “Current betting market data indicates that Trump is leading over Kamala Harris, with Trump suggesting the U.S. could become a significant oil supplier. Such a policy shift could exert downward pressure on prices.” While betting markets favor Trump, alternative polling indicates that the election results remain highly competitive and uncertain.

Click here to read the full article

Source: Oil & Gas 360

—

If you have any questions or thoughts about the topic Oil prices broadly stable, feel free to contact us here or leave a comment below.