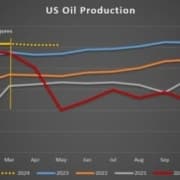

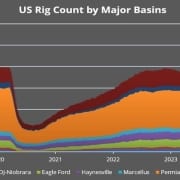

Oil prices surged this week as hurricane season began, demand improved, and both U.S. crude and gasoline inventories fell. This triggers supply concerns. Rising geopolitical risk around the world only added to bullish sentiment.

Friday, June 21, 2024

The onset of hurricane season in the US is improving demand figures. It is corroborated by shrinking crude and product inventories. It is becoming more visible Chinese buying have come together to lift oil prices to their highest since early May. The market was also reminded of the dysfunctional Red Sea navigation with the Houthis sinking another bulker this week, adding upward pressure to oil prices.

Chevron-Hess Merger Stalled by Arbitrage Delays.

Three months have passed since the case for a contract arbitration panel on Chevron’s planned takeover of Hess’ Guyana assets was filed. Still, there is no final arbitrator selected, delaying the $53 billion merger.

Alberto Becomes the New Scare for the Gulf.

A storm system has made landfall in Mexico’s northeast regions. It is becoming the first named tropical storm of the 2024 Atlantic hurricane season, with Tropical Storm Alberto bringing heavy rains that disrupted lightering operations in Corpus Christi and Beaumont.

Here Comes the New PE-Backed Gas Giant.

US private equity giant Carlyle Group (NASDAQ:CG) will form a new Mediterranean-focused oil and gas company after purchasing Energean’s (LON:ENOG) assets in Italy, Croatia, and Egypt for $945 million, naming former BP boss Tony Hayward as its new CEO.

Europe Approves 14th Russia Sanctions Package.

The European Union approved a 14th package of sanctions against Russia that bans re-exports of Russian LNG in the EU, however steering clear of banning LNG imports per se, whilst also blocking any financing for Russia’s planned Arctic and Baltic LNG terminals.

Click here to read the full article

Source: Oil Price

—

Do you have any questions or thoughts about the topic related to supply concerns? Feel free to contact us here or leave a comment below.