⚠️ IMPORTANT LEGAL DISCLAIMER:

The information provided on this page is for general informational purposes only and does not constitute legal, financial, or investment advice. Oil and gas laws, mineral rights regulations, and royalty structures vary significantly by state and jurisdiction. While we strive to provide accurate and up-to-date information, no guarantee is made to that effect, and laws may have changed since publication.

You should consult with a licensed attorney specializing in oil and gas law in your jurisdiction, a qualified financial advisor, or other appropriate professionals before making any decisions based on this material. Neither the author nor the publisher assumes any liability for actions taken in reliance upon the information contained herein.

The evolution of mineral rights in the United States has played a critical role in shaping the nation’s economic, legal, and industrial landscape. From early colonial practices to contemporary policies, the history of mineral rights reflects changing attitudes toward property, resource ownership, and national development. Today, the U.S. is one of the few countries where private individuals can own the rights to underground minerals, a principle that has its roots in centuries of legal and political evolution.

This article delves into the key historical developments that have defined mineral rights in the United States. We will explore the foundational legal doctrines, landmark legislative acts, major court decisions, and significant shifts in industry practices that have collectively built the modern framework for mineral rights. Understanding this history offers valuable insight for landowners, investors, legal professionals, and policymakers alike.

Foundations of Mineral Ownership in Early America

The early foundation of mineral rights in the U.S. was shaped by English common law, which generally held that landowners possessed the rights to everything above and below the surface of their land. This concept, known as the ad coelum doctrine, was largely adopted by the American colonies and later the U.S. legal system. Under this doctrine, surface landowners automatically held the rights to any minerals found beneath their property.

However, during colonial times, the Crown often retained ownership of valuable minerals such as gold and silver. These mineral reservations were an early example of separating mineral rights from surface rights, a concept that would become increasingly common in U.S. law.

The Influence of Westward Expansion

As the United States expanded westward, the discovery of valuable mineral resources such as gold, silver, coal, and oil transformed the national economy. The Gold Rushes and subsequent mining booms led to an influx of settlers and prospectors into mineral-rich regions, often ahead of formal government regulation.

During this period, informal practices like staking claims and establishing mining districts developed as ad hoc methods of regulating mineral extraction. These practices eventually influenced federal policy, leading to the formalization of mineral rights in federal law.

Emergence of Federal Mining Legislation

To bring order and legal clarity to the chaotic mining activities on public lands, the U.S. government passed several landmark legislative acts. These laws laid the groundwork for modern mineral rights and established the federal government’s role in regulating resource extraction.

Among the most significant was the Mining Law of the late nineteenth century. This act allowed individuals to explore and claim mineral deposits on federal lands, provided they complied with specific requirements. It formalized the concept of “locatable” minerals and introduced the patenting process, which enabled claimants to obtain legal title to both surface and mineral rights.

The Homestead Act and similar laws also played a role by granting land to settlers under certain conditions. Although these acts primarily addressed agricultural use, they influenced the patchwork of surface and mineral ownership across the American West.

Severance of Surface and Mineral Rights

A pivotal development in U.S. mineral law was the growing practice of severing mineral rights from surface rights. This meant that one party could own the surface of a piece of land while another held the rights to the minerals beneath it.

This separation became particularly common in transactions involving railroads, energy companies, and large landholders. The practice created complex legal relationships and introduced the need for detailed deeds, leases, and easements to manage access and extraction.

Courts across the U.S. began addressing disputes arising from these severed estates, contributing to a growing body of case law that clarified the rights and responsibilities of surface and mineral owners. The concept of the dominant estate—where the mineral estate has the implied right to use the surface for extraction—became a cornerstone of this jurisprudence.

Rise of the Oil and Gas Industry

The discovery and commercialization of oil and gas marked a transformative chapter in U.S. mineral rights history. With oil and gas development came the need for new legal instruments, particularly the mineral lease. Under such leases, landowners could grant companies the right to explore and produce oil or gas in exchange for royalties and other compensation.

Standardized lease forms and practices emerged over time, setting the stage for widespread domestic energy development. States began enacting their own oil and gas regulations, resulting in a mix of legal frameworks that varied across jurisdictions but shared common principles.

The rule of capture also became a defining legal doctrine, allowing the first party to extract oil or gas from a common reservoir to claim it as their own—even if it migrated from neighboring land. This incentivized rapid development and contributed to early overproduction and waste, prompting the eventual establishment of conservation and unitization laws.

Federal and State Regulatory Evolution

Over time, both federal and state governments expanded their regulatory oversight of mineral extraction to address environmental, safety, and economic concerns. Agencies such as the Bureau of Land Management and state-level oil and gas commissions were tasked with issuing permits, inspecting operations, and enforcing compliance.

Legislation addressing environmental protection, such as the Clean Air Act, Clean Water Act, and the National Environmental Policy Act, introduced new obligations for mineral developers. These laws added layers of complexity to the permitting process and increased the importance of due diligence in mineral rights transactions.

States also introduced severance taxes on the extraction of oil, gas, and minerals, generating revenue for public programs and infrastructure. The interplay between taxation and royalty structures continues to shape investment decisions in the sector.

Technological Advancements and Their Legal Impact

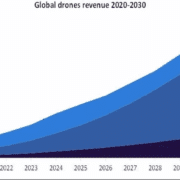

Technological innovations have had a profound effect on mineral rights and resource development. Techniques like hydraulic fracturing and horizontal drilling opened new resource frontiers, particularly in shale formations previously deemed uneconomical.

These advances sparked renewed interest in mineral rights ownership and leasing, often leading to complex negotiations between landowners and energy companies. Legal disputes over subsurface trespass, pore space rights, and split estates intensified, prompting new case law and legislative responses.

Increased digitization of land records and the use of geospatial technologies have also improved the accuracy and transparency of mineral title searches, making it easier to determine ownership and resolve conflicts.

Native American Mineral Rights and Sovereignty

Mineral rights on Native American lands represent a unique and historically significant aspect of U.S. mineral law. Tribes retain sovereignty over their lands, including subsurface resources, but development is subject to federal oversight through agencies like the Bureau of Indian Affairs.

Historically, tribes were often excluded from the benefits of resource development on their lands. However, recent decades have seen increased efforts to assert tribal control and negotiate more favorable agreements. Successful examples include tribal-owned energy companies and partnerships that prioritize environmental stewardship and community benefit.

Legal reforms and landmark court decisions have helped affirm tribal rights and promote greater self-determination in mineral development, although challenges related to bureaucracy, funding, and legal complexity remain.

Contemporary Legal and Policy Challenges

Today, the landscape of mineral rights in the United States continues to evolve in response to shifting energy markets, environmental concerns, and societal values. Legal debates center around issues such as fracking bans, landowner consent, and climate change mitigation.

Efforts to transition toward renewable energy sources have raised questions about the long-term role of fossil fuels and the relevance of traditional mineral rights frameworks. At the same time, the growing demand for critical minerals—used in batteries, electronics, and green technologies—has revived interest in domestic mining.

Public land management policies are under scrutiny, with debates over leasing practices, royalty rates, and environmental safeguards becoming more prominent. Meanwhile, private landowners are increasingly aware of their rights and responsibilities, leading to more strategic and informed decision-making.

The history of mineral rights in the United States is a complex tapestry woven from centuries of legal, economic, and technological developments. From the foundational doctrines of common law to the modern dynamics of energy and environmental policy, each phase has contributed to a unique system where mineral ownership is both a privilege and a responsibility.

Understanding this history is essential for anyone involved in land management, resource development, or legal practice. It provides context for current debates and guidance for navigating the evolving landscape of American mineral rights.

As the nation looks toward a future defined by sustainability and innovation, the principles that underpin mineral rights will continue to be tested and redefined. Yet, the legacy of past developments ensures that mineral ownership will remain a cornerstone of American legal and economic life for generations to come.

Do you have any questions related to The History of Mineral Rights? Reach out to us here.

Remember: This information is for educational purposes only. Consult qualified professionals for advice specific to your situation and jurisdiction.