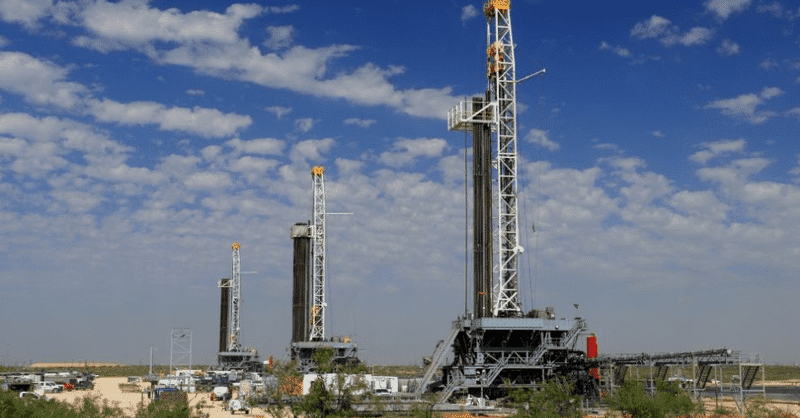

Despite billions of dollars’ worth of consolidation in the U.S.’ most prolific shale play, the Permian Basin remains thriving at a key place to deploy private equity capital. Portfolio companies can build into successful enterprises ripe for acquisition—but it’s not a job for just anybody.

Hart Energy queried top private equity firms invested in the Permian about what’s next for the most prolific shale play in the U.S. This interview with William J. “Billy” Quinn, founder and managing director at Pearl Energy Investments, is the first in a three-part series.

Click here to read the full article

Source: HARTENERGY

—

Do you have any questions or thoughts about the topic on how Permian thriving? Feel free to contact us here or leave a comment below.