In its weekly release, Baker Hughes Company stated that the U.S. drilling rig count was higher than the prior week’s figure. The rotary rig count, issued by BKR, is usually bring out in major newspapers and trade publications.

Baker Hughes’ data, issued at the end of every week since 1944, helps energy service providers gauge the overall business environment of the oil and gas industry. The number of active rigs and its comparison with the week-ago figure indicates the demand trajectory for the company’s oilfield services from exploration and production companies.

Rig Count Data in Detail

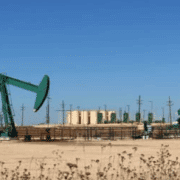

Total U.S. Drilling Rig Count Rises: The number of rigs engaged in the exploration and production of oil and natural gas in the United States was 625 in the week ended Dec 1. The figure is higher than theweek-ago count of 622. Although the figure increased for three straight weeks, there has been a slowdown in drilling activities. Some analysts think that shale producers are getting more efficient, requiring fewer rigs, while some doubt whether certain producers have enough prospective land to drill. The current national rig count is, however, lower than the year-ago level of 784.

Click here to read the full article

Source: ZACKS

—

If you have any questions or thoughts about the topic, feel free to contact us here or leave a comment below.