KEY POINTS ON OIL PRICES RISE:

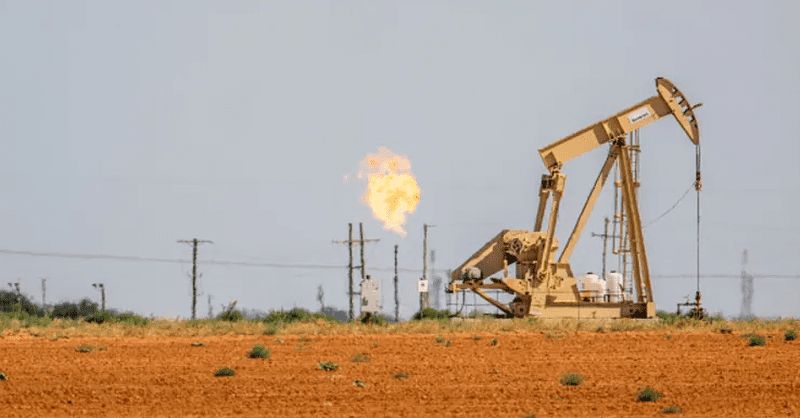

-Crude oil futures climbed on Thursday, getting a lift from cooling inflation data.

-The consumer price index fell 0.1% in June from the prior month, bringing the 12-month rate to 3%.

-The inflation data bolstered hopes for interest rate cuts from the Federal Reserve in September. Lower rates stimulate economic growth, which can boost demand for oil.

Crude oil futures rose Thursday as inflation eased. It is bolstering hopes that the Federal Reserve will cut interest rates later this year.

Inflation as measured by the consumer price index dropped 0.1% from May to June. It is putting the 12-month rate at 3%, near the lowest level in more than three years, according to the U.S. Department of Labor.

The market is expecting the Federal Reserve to start cutting interest rates in September. Lower interest rates typically stimulate economic growth, which can bolster crude oil demand.

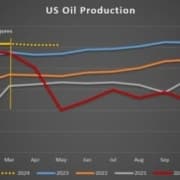

The inflation and interest rate outlook overshadowed mixed signals on oil demand for this year. The Paris-based International Energy Agency said global demand growth eased to 710,000 barrels per day year on year in the second quarter, the slowest increase since the fourth quarter of 2022, as consumption in China contracted.

The IEA is forecasting global oil demand growth will average just under one million barrels per day in 2024 due to subpar economic growth, greater energy efficiency and electric vehicle adoption.

OPEC, on the other hand, is much more bullish, forecasting demand growth of 2.2 million barrels per day as the cartel sees solid economic growth of 2.9% this year.

Click here to read the full article

Source: CNBC – Trusted Resource

—

If you have any questions or thoughts about the topic related to oil prices rise, feel free to contact us here or leave a comment below.