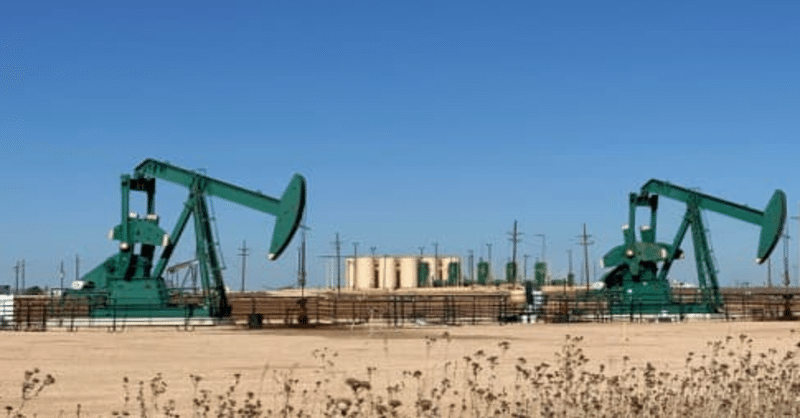

The total number of active drilling rigs for oil and gas in the United States rose this week, according to new data that Baker Hughes published on Friday. Let’s talk more about oil and gas rig count.

The total rig count in the US rose to 548 this week, according to Baker Hughes, down 37 from this same time last year.

The number of active oil rigs stayed the same in the reporting period, according to the data, at 414. Year over year, this represents a 65-rig decline. The number of gas rigs rose by 3 to 128, which is 26 more than this time last year. The miscellaneous rig count fell by 1 to 6.

Click here to read the full article

Source: Oil Price

—

Do you have any questions or thoughts about the topic related to Oil and gas rig count? Feel free to contact us here or leave a comment below.