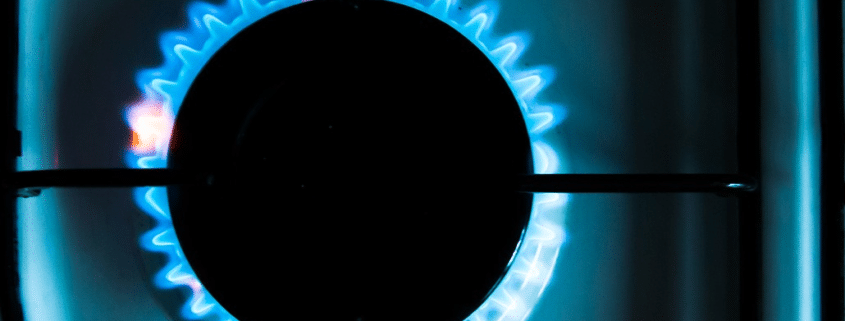

Natural Gas Prices Set To Expand

The U.S. will need to significantly reduce domestic oil production to prevent a protracted period of sub-$30 WTI, a level that leaves almost no producer profitable. Over the last 10 years, technology and access to capital have allowed for rapid growth in oil production as well as in associated gas volumes. Historic reductions in drilling rig counts suggest that this rationalization process is underway. Let’s talk further about natural gas prices.

This will lead to a rebalancing of U.S. natural gas supply/demand dynamics. 2021 NYMEX pricing is already reflecting some of this effect. To rebalance the oil supply function, shut-ins will benefit gas producers. The ability of natural gas producers to hedge forward production at current 2021 levels results in substantial FCF for low-cost producers.

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you’ll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to read the full article.

Source: Seeking Alpha

If you have further questions related to Natural Gas Prices, feel free to reach out to us here.

Leave a Reply

Want to join the discussion?Feel free to contribute!