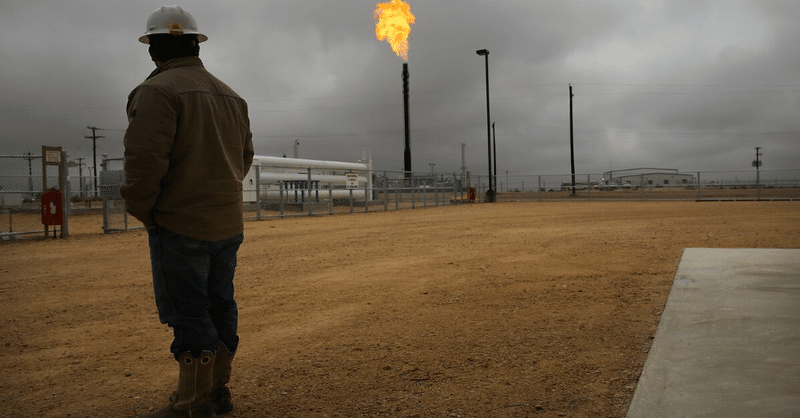

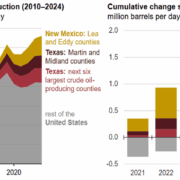

Canada’s Gibson Energy Inc. is betting that swelling oil output in the Permian Basin will fuel continued growth in US crude exports, boosting profit from a major Gulf Coast terminal it bought last year for about $1.1 billion.

The acquisition of the South Texas Gateway Terminal — which expanded Gibson beyond its core business of storing and processing Canadian crude in Alberta and Saskatchewan — is seen by analysts as a key earnings driver for the company. While Gibson has plans to generate more revenue from the terminal through physical improvements and enhanced contracts, the deal is also a macro bet on growing US oil exports.

Click here to read the full article

Source: Bloomberg

—

If you have any questions or thoughts about the topic, feel free to contact us here or leave a comment below.