The Bureau of Land Management’s first oil and gas lease sale in over a year netted roughly $14.7 million in Wyoming — about $1.8 million more than last year’s sale.

Wyoming will receive 48% — roughly $7 million — of that revenue.

While Gov. Mark Gordon applauded the lease sale in a Monday statement, he noted that it represents “not even a quarter of a loaf.”

“The fact that our producers participated to the degree they did is a credit to the Wyoming oil and gas industry,” Gordon said. “Their efforts mean Wyoming will continue to provide energy for the Nation, even though they do so with increasing pressure from Washington, DC, to give up.”

Federal law requires the Bureau of Land Management to hold lease sales each year on a quarterly basis. But in 2021, President Joe Biden signed an executive order to pause these sales as part of his plan to address climate change by making the environmental review process for sales more stringent.

The higher mandatory fees required by the Inflation Reduction Act mean higher fuel prices at the pump. Since Wyoming receives 48 percent of royalty rates, bonus bids and rental payments, the State will receive more revenue due to the increased federal fees, which comes at a cost to consumers and the oil and gas economy.

The Wyoming oil and gas industry has yet to regain the number of drilling rigs or employees it had in 2019. The number of drilling rigs for 2023 has hovered around 20, slightly more than half of the number in 2019.

Click here to read the full article

Source: Casper Star-Tribune

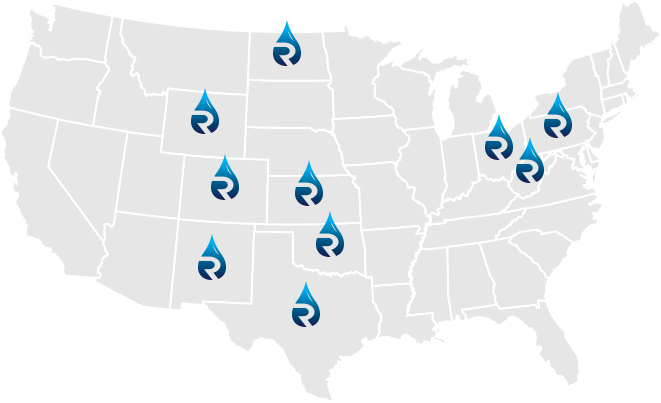

If you have further questions about the topic of the Oil and Gas lease sale, feel free to contact us here.