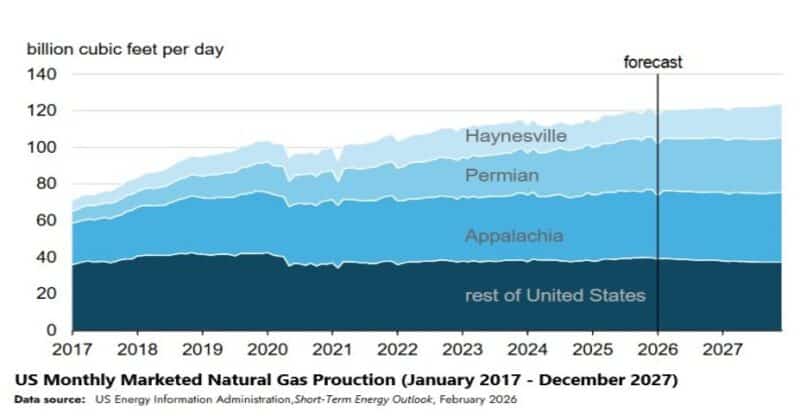

The U.S. Energy Information Administration (EIA) projects U.S. marketed natural gas production will rise about 2% to average 120.8 Bcf/d in 2026 and then increase to a record 122.3 Bcf/d in 2027. The agency expects roughly 69% of the next two years’ output to come from three core regions: Appalachia, Haynesville, and the Permian.

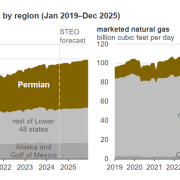

EIA attributes much of the growth to higher forecast prices supporting activity in Haynesville, where production is expected to increase by about 1.2 Bcf/d in 2026 and 1.6 Bcf/d in 2027. The outlook also notes the region’s proximity to Gulf Coast LNG export terminals and major industrial demand. In the Permian, EIA expects gas volumes to grow mainly as associated gas from oil production, aided by rising gas-to-oil ratios, with the basin contributing 1.4 Bcf/d of growth in 2026 and 0.6 Bcf/d in 2027. Appalachia is projected to post modest gains as additional takeaway capacity supports incremental increases after recent constraints—context that mineral owners often evaluate alongside average natural gas well production benchmarks and basin-specific dynamics like Permian associated gas trends.

Source: Gas Compression Magazine

Read the full original article here