The information provided on this page is for general informational purposes only and does not constitute legal, financial, or investment advice. Oil and gas laws, mineral rights regulations, and royalty structures vary significantly by state and jurisdiction. While we strive to provide accurate and up-to-date information, no guarantee is made to that effect, and laws may have changed since publication.

You should consult with a licensed attorney specializing in oil and gas law in your jurisdiction, a qualified financial advisor, or other appropriate professionals before making any decisions based on this material. Neither the author nor the publisher assumes any liability for actions taken in reliance upon the information contained herein.

So you’ve got to move, it’s a shame. No matter what lies next, it is almost always difficult. Difficult to let go of the land and home in which you have spent so much of your life in. What makes it even tougher, however, is if that land is also earning you a monthly income. That’s a situation where you, as a seller, want to retain mineral rights to land.

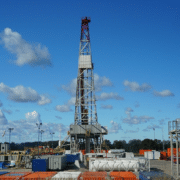

For some, leasing mineral rights is a highly profitable venture in which little effort is needed. If you own your land and have leased your mineral rights to an oil and gas company that is drilling and selling precious minerals, then you are earning oil and gas royalties. Surely, you’d like to keep those checks coming in the mail, right?

Retaining Mineral Rights in a Sale of Land

Well, the answer is yes. You can sell your land and keep your mineral rights. In order to do so, you must add an exception in the contract for the sale of your land. You will be entering into a split estate contact with the new party, who will now be the owner of the surface rights.

Benefits of Keeping Your Mineral Rights

Are you receiving royalties from your mineral rights? Then, retaining their ownership will keep your income stream steady. If your land has not yet been explored for oil, gas, or precious minerals, then your non-producing mineral rights still may be valuable. If a company were interested in drilling on your property, as the mineral rights owner, you would be in charge of the negotiation.

Downsides When Seller Wants to Retain Mineral Rights to Land

Unfortunately, everything isn’t always going to work out one hundred percent in your favor. If you are the seller who wants to retain mineral rights (especially if there is active drilling), the pool of interested people is going to shrink. Some potential buyers may not like the idea of only owning the surface rights. Especially while the mineral rights are under maintenance by someone else. This may result in a lowered negotiated price for the sale of the land.