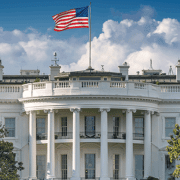

Crude oil prices set for their third weekly rise as concern grew about supply after President Trump threatened 25% tariffs on any country buying Venezuelan crude while stepping up sanctions on Iranian entities.

At the time of writing, Brent crude was trading at $73.91 per barrel while West Texas Intermediate was changing hands for $69.80 per barrel, both set to end the week about $1 per barrel higher than they started it.

Sparta Commodities analyst June Goh told Reuters that the potential loss of Venezuelan crude exports to the market due to secondary tariffs and the possibility that the same tariffs may be imposed on Iranian barrels has caused an apparent tightness in crude supply.

On Monday, President Trump said in an executive order that “On or after April 2, 2025, the United States may impose a tariff of 25 percent on all goods imported from any country that imports Venezuelan oil, whether directly from Venezuela or indirectly through third parties.”

This caught many traders and refiners off guard, especially in China, which is the biggest buyer of Venezuelan crude. It is also the biggest buyer of Iranian crude oil, which also came under attack from the Trump administration as soon as this administration took office.

Click here to read the full article

Source: Oil Price

—

Do you have any questions or thoughts about the topic of oil prices set? Feel free to contact us here or leave a comment below.