Amidst attacks on U.S. energy production and continued global instability, the U.S. oil and natural gas industry managed to not only meet but exceed expectations in 2023. The industry broke production records and supplied critical energy resources at home and abroad, all while reducing methane emissions.

Oil and Gas Industry Continues to Innovate Amid Record Production

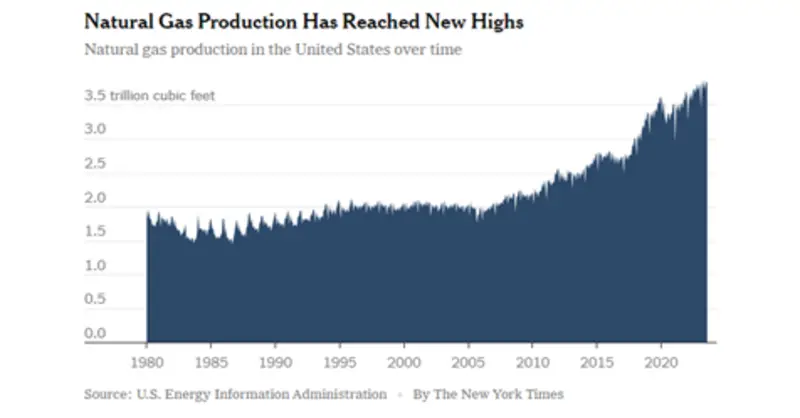

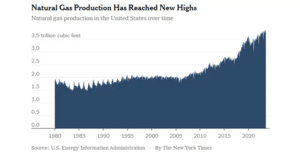

In 2023, the oil and natural gas sectors continued to innovate and reach record breaking levels of production. After becoming a net energy exporter in 2019, the United States has emerged as a behemoth in the global energy market, hitting prolific levels of oil and natural gas production and exports in the past year.

U.S. liquified natural gas (LNG) had a tremendous year with the United States becoming the top LNG exporter in the world.

These record-breaking levels of production have not come at the expense of Americans as some activists claim. To the contrary, record energy production levels have successfully been able to meet both domestic and international demand, providing crucial energy security at home and abroad, all while keeping prices stable.

Click here to read the full article

Source: Energy in Depth

—

If you have any questions or thoughts about the topic, feel free to contact us here or leave a comment below.