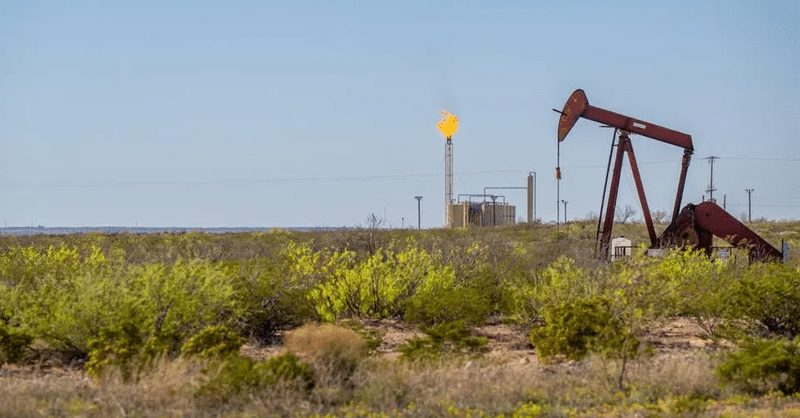

US Oil and Gas

Last year marked a record for US oil and gas production with an average daily production of 12.93 million barrels per day (BPD). That record was 5% greater than the previous record of 12.31 million bpd set in 2019.

However, current data from the Energy Information Administration (EIA) shows that average daily production thus far in 2024 is 13.12 million bpd — 7.1% ahead of the production level of a year ago and 1.4% higher than last year’s record pace.

U.S. natural gas production tells a similar tale. The EIA recently confirmed that 2023 marked a record for U.S. natural gas production at 125 billion cubic feet per day (CFD). That was 4% ahead of the previous record set in 2022.

Natural gas data isn’t reported as often as petroleum data, but January’s natural gas production level was 124.6 billion CFD. That followed a monthly production record in December 2023. It was slightly behind last year’s record level, but there are some seasonal effects in natural gas production. If we compare January 2024 to January 2023, this year’s production level was 1.1% higher than a year ago.

Click here to read the full article

Source: Forbes

—

If you have any questions or thoughts about the US oil and gas topic, feel free to contact us here or leave a comment below.