DISCLAIMER: We are not financial advisors. The content on this website related to surface rights role is for educational purposes only. We merel cite our personal opinions. In order to make the best financial decision that suits your own needs, you must conduct your own research and seek the advice of a licensed financial advisor if necessary. Know that all investments involve some form of risk and there is no guarantee that you will be successful in making, saving, or investing money; nor is there any guarantee that you won’t experience any loss when investing. Always remember to make smart decisions and do your own research!

In the oil and gas industry, leasing is a fundamental mechanism for extracting valuable resources from the earth. However, the process of oil and gas leasing involves much more than simply negotiating royalty rates or securing drilling rights. One critical element often overlooked in discussions about resource extraction is the concept of surface rights.

These rights play a crucial role in determining how landowners and operators conduct oil and gas operations, and they can significantly affect the interests of both parties.

Surface rights pertain to the use and access to the land’s surface, which is separate from the subsurface rights that typically govern the extraction of oil, gas, and minerals beneath the ground. This distinction can create potential conflicts and raise important questions about how landowners and operators can coexist while extracting resources. This article explores the role of surface rights in oil and gas leasing, examining the relationship between surface and subsurface rights, the impact on landowners, and the regulatory framework governing surface use during oil and gas operations.

Understanding Surface Rights and Subsurface Rights

Before diving into the intricacies of oil and gas leasing, it’s essential to distinguish between surface rights and subsurface rights. Surface rights grant the landowner or leaseholder the right to use and occupy the land’s surface for various purposes, such as farming, building, and recreational activities. Subsurface rights, on the other hand, pertain to the rights to explore, develop, and extract resources located beneath the surface, such as oil, gas, minerals, and coal.

In the context of oil and gas leasing, a landowner may own the surface rights to a piece of land while another party or an oil and gas company could own or lease the subsurface rights.

Alternatively, the same party may own both surface and subsurface rights. The ownership structure can have significant implications for oil and gas operations, particularly in terms of access to the land and compensation for the use of the surface during extraction activities.

The Separation of Surface and Subsurface Rights

The separation of surface rights and subsurface rights is not uncommon, especially in areas with rich mineral and oil deposits. The historical reason for this division lies in the concept of property rights, which allows landowners to retain control over the surface of their land while allowing others to extract resources below. Over time, as the demand for natural resources grew, oil and gas companies began acquiring subsurface rights for exploration and production, sometimes without acquiring the underlying surface rights.

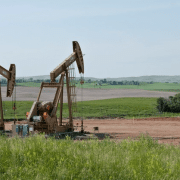

This separation of rights can create tension between surface owners and subsurface owners or operators. For example, an oil and gas operator may need to access the surface for drilling, building infrastructure, and conducting operations, which can interfere with the surface owner’s ability to use the land as they see fit. The operator may need to clear land, build access roads, or construct drilling rigs, activities that can disrupt farming, ranching, or residential uses of the land.

In most cases, oil and gas operators seek to minimize disruption to the surface owner’s activities, but conflicts can arise if there is insufficient communication or if the operator’s activities cause significant damage. Surface rights are, therefore, a critical aspect of oil and gas leasing agreements, as both surface and subsurface rights holders must negotiate terms that allow for resource extraction while preserving the integrity of the land.

The Importance of Surface Use in Oil and Gas Leasing

When negotiating an oil and gas lease, the surface rights are just as important as the subsurface rights, especially for landowners. The oil and gas operator’s need to access the surface of the land for exploration, drilling, and production activities makes surface rights a vital consideration in the leasing process. Some key factors related to surface use include:

Access for Exploration and Development

Before oil and gas extraction can begin, the operator needs access to the surface of the land for seismic surveys, exploratory drilling, and the establishment of production sites. The operator may need to clear land for building roads, drilling rigs, storage facilities, and pipelines. These activities can disrupt the surface landowner’s activities and affect the land’s usability.

A well-defined lease agreement should outline the terms of access, specifying which portions of the land the operator will use, the timeframe for operations, and how the operator will minimize disruption to surface activities.

Compensation for Surface Use

The use of surface land by oil and gas operators typically requires compensation to the surface rights holder. This compensation may come in various forms, including a lump-sum payment, annual payments, or a percentage of the revenue generated by the oil and gas extraction. The amount of compensation depends on several factors, such as the type of land, the extent of surface disruption, and the potential value of the oil and gas resources being extracted.

In some cases, surface rights owners may receive compensation for damages caused by the oil and gas operations, such as damage to crops, fences, or other infrastructure. The terms of compensation should be explicitly stated in the lease agreement to prevent future disputes over land use.

Restoration of the Surface After Operations

Landowners involved in oil and gas leasing consider surface damage to be one of the most significant concerns.

This is known as land reclamation, and it involves repairing any damage caused by drilling, road construction, or the installation of production equipment. Reclamation is a critical component of oil and gas leasing because it ensures that the surface owner’s land can be returned to productive use after the operator has completed their work.

Surface rights owners should negotiate terms that include provisions for damage assessment, compensation, and reclamation to safeguard their interests and ensure that they protect the land for future generations.

The Potential for Surface Damage and Disputes

Surface damage is one of the most significant concerns for landowners involved in oil and gas leasing. The landowner may lose valuable crops, livestock, or land use due to drilling activities, construction of access roads, and the installation of infrastructure like pipelines and storage tanks. While many oil and gas operators work to minimize surface disruption, damage is sometimes inevitable, particularly if the land is in a sensitive area or if the extraction process is extensive.

Landowners may also face concerns over the long-term impact of oil and gas operations on the health of the land. For example, drilling and production operations can lead to soil contamination, water pollution, and the destruction of ecosystems. Surface rights owners should negotiate terms that include provisions for damage assessment, compensation, and reclamation to safeguard their interests and ensure that the land is protected for future generations.

The Role of Surface Use in Environmental Regulations

Oil and gas operations are subject to a complex regulatory framework designed to protect the environment and ensure the safety of operations. This framework includes federal, state, and local regulations governing the use of surface land during oil and gas extraction.

Environmental regulations often address issues such as water quality, air pollution, waste management, and wildlife protection. Operators must comply with these regulations when conducting surface activities, such as drilling, land clearing, and waste disposal. Surface rights holders should be aware of these regulations and ensure that operators adhere to them throughout the duration of the lease.

Surface owners may challenge the operator’s activities in some cases if they believe that the operator is violating environmental regulations.

For instance, if an operator’s drilling activities cause harm to local water sources or disrupt wildlife habitats, the surface rights holder may have legal grounds to seek remediation or compensation.

The Legal Framework for Surface Rights Role in Oil and Gas Leasing

The legal framework governing surface rights in oil and gas leasing varies by jurisdiction, but there are general principles that apply across most regions.

In the United States, state law typically governs oil and gas leases, though federal law can also come into play when federal lands are involved. The lease agreement is the central document that governs the relationship between the surface rights holder and the oil and gas operator.

The lease agreement should clearly outline the rights and responsibilities of both parties, including:

- Access and Use: The terms under which the operator can access and use the surface, including specific areas of land and the duration of access.

- Compensation: The amount and method of compensation for the use of the surface, including payments for damage and land restoration.

- Reclamation: The operator’s obligation to restore the surface after operations are completed, including specific timelines and standards for land reclamation.

- Environmental Protections: The operator’s responsibility to comply with environmental regulations and mitigate any harm caused to the land, water, or wildlife.

Landowners commonly face disputes over surface rights and land use in the oil and gas industry, so they should consult legal professionals to ensure that they protect their interests in the lease agreement. In some cases, landowners may resolve disputes through negotiation or mediation, while in other cases, they may require legal action.

Balancing Surface Rights Role and Subsurface Interests

The role of surface rights in oil and gas leasing is an often-overlooked but critical component of the resource extraction process.

Landowners govern the use of their property during oil and gas operations through surface rights, playing a vital role in protecting their interests and ensuring that operators adhere to environmental and legal standards.

Understanding the balance between surface and subsurface rights is essential for both landowners and operators.

By negotiating clear and fair terms for surface use, compensation, and reclamation, both parties can work together to ensure that they conduct oil and gas operations in a manner that minimizes disruption to the land and protects the environment for future generations.

With careful planning, clear communication, and a thorough understanding of surface rights, landowners and operators can navigate the complexities of oil and gas leasing and create mutually beneficial agreements that allow for resource extraction while preserving the integrity of the land.

Do you have questions about surface rights role? Feel free to contact us here.