South Korea is interested in importing more U.S. oil and gas to diversify energy sources and ensure stable supplies given tensions in the Middle East, the country’s industry minister Ahn Duk-geun said on Thursday.

The government may need to increase support for the purchase of non-Middle East oil, he told reporters in Seoul.

His comments come as U.S. President-elect Donald Trump, who takes office on Jan. 20, has vowed to impose tariffs of 10% on global imports into the U.S., and said the European Union should step up U.S. oil and gas imports or face tariffs on the bloc’s exports, including on goods such as cars and machinery.

In 2024, South Korea posted a record $55.7 billion trade surplus with the United States, up 25.4% from a year earlier.

South Korea was the world’s fourth-largest buyer of crude oil and the third-biggest liquefied natural gas (LNG) importer.

South Korea has deepened its reliance on crude oil imports from the Middle East, which accounted for 72% of total imports in 2023, up from 60% in 2021, according to the energy ministry.

For LNG, South Korea imported 47.2 million metric tons of the super-chilled fuel in 2024, of which 5.7 million metric tons were from the U.S., according to data from analytics firm Kpler.

Other LNG-importing countries such as Vietnam could also buy from the U.S. to ease its large trade surplus with the world’s top economy, said a senior Hanoi-based diplomat.

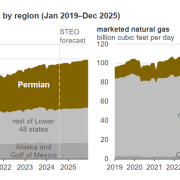

The U.S. is the world’s top LNG exporter.

Sources said that Trump plans to make it easier for some LNG producers to seek export permit renewals, while his pick to head the U.S. Energy Department told senators that his first priority is expanding domestic energy production, including LNG.

Click here to read the full article

Source: Natural Gas World

—

Do you have any questions or thoughts about the topic on South Korea Buying oil and gas?, feel free to contact us here or leave a comment below.