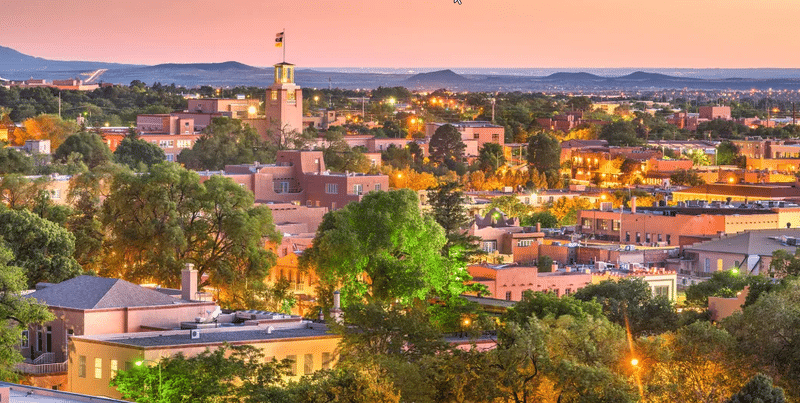

In his recent visit to the Land of Enchantment, Energy Secretary Chris Wright underscored New Mexico’s national significance in energy production. This is highlighting its vital role in meeting growing U.S. energy demands through oil. Moreover through solar, and emerging nuclear and geothermal industries. Simultaneously, the state is enjoying more than $800 million in new tax revenue from oil and natural gas extracted from the Permian Basin in the southeast corner of the state. The oil and gas tax revenue has grown over 50 percent in the last year. It is worth $2.1 billion. It represents over 20 percent of the state’s annual budget. Learn more about the permanent oil and gas fund.

This government-controlled wealth has prompted an urgent and consequential question: How do we transform today’s abundance into lasting prosperity? The Southwest Public Policy Institute believes the answer lies in empowering New Mexicans. It is directly by establishing a permanent fund dividend (NMPFD). Modeled after Alaska’s successful program, this proposal offers a path toward economic freedom, poverty alleviation, and long-term stability.

Click here to read the full article

By Patrick M. Brenner

Originally published in National Review, March 5, 2025.

Patrick M. Brenner is the founder and president of the Southwest Public Policy Institute, a nonprofit research institute dedicated to improving quality of life in the American Southwest through sound public policy solutions. He can be found on X at @pmbrenner91

—

Do you have any questions or thoughts about the topic of a permanent oil and gas fund? Feel free to contact us here or leave a comment below.