US-based private equity firm Quantum Capital Group has recently finalized an acquisition deal. It is with Caerus Oil and Gas, a prominent energy company. They are operating in the Rocky Mountain region. The agreement, valued at $1.8 billion, marks a significant move in the energy sector. It underscores Quantum Capital’s strategic expansion plans. According to reports from Bloomberg, sources have confirmed the successful acquisition. It involves Quantum Capital purchasing Caerus from its existing investors. Moreover, it includes Oaktree Capital Management, Anschutz Investment Company, and Old Ironsides Energy.

The transaction has garnered attention in the industry, and representatives from Quantum Capital and Caerus have refrained from offering official comments on the matter. The news has sparked curiosity and speculation among industry experts and stakeholders. This is as the acquisition signals a potential shift in ownership dynamics within the energy market. Despite requests for clarification, parties involved in the deal, including Oaktree Capital Management, Anschutz Investment Company, and Old Ironsides Energy, have chosen to remain tight-lipped, leaving room for anticipation and analysis within the investment community.

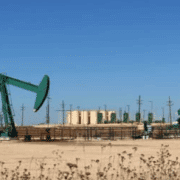

Caerus currently operates more than 7,400 wells across the Piceance Basin in Colorado and Uinta Basin in Utah.

The company also has related infrastructure including more than 3,862km of gas and water pipelines, as well as numerous water treatment and storage facilities.

“Quantum Capital to acquire Caerus Oil and Gas in $1.8bn deal ” was originally created and published by Offshore Technology, a GlobalData owned brand.

Click here to read the full article

Source: yahoo!finance

—

If you have any questions or thoughts about the topic, feel free to contact us here or leave a comment below.