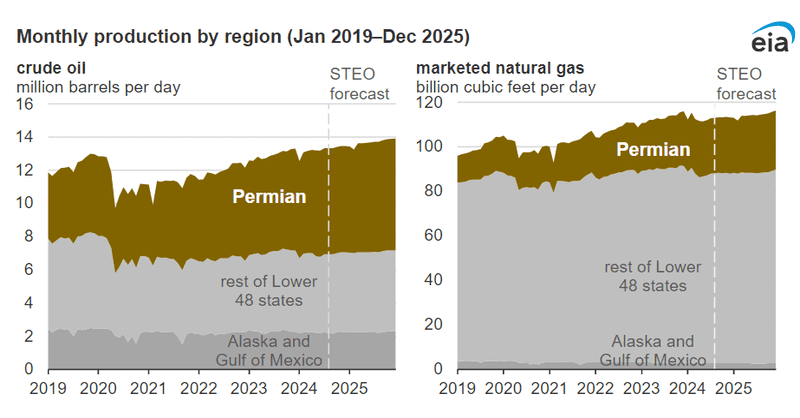

In our latest Short-Term Energy Outlook (STEO), we forecast that crude oil production in the United States. It will grow to an average of 13.7 million barrels per day (b/d). The market for natural gas production will grow to an average of 114.3 billion cubic feet per day (Bcf/d) in 2025. Most of the forecast growth in oil and natural gas production comes from the Permian region of western Texas and eastern New Mexico. It is where we expect productivity gains, new and expanded infrastructure, and high crude oil prices will support rising production.

In order to better capture drilling activity in several onshore U.S. regions, our STEO now makes use of multiple drilling productivity metrics. The number of active rigs is the first in a sequence of metrics that affects regional production; currently more rigs are active in the Permian region than in the rest of the Lower 48 states combined. We also capture and report the number of new wells that those rigs have drilled each month.

Drilled but uncompleted wells (DUCs) have been drilled but have not yet undergone well completion activities to start producing hydrocarbons. The well completion process involves casing, cementing, perforating, hydraulic fracturing, and other procedures required to produce crude oil or natural gas. Ultimately, when these wells are completed, they begin producing crude oil, natural gas, or both.

Producers make decisions on drilling and completion operations based on market conditions, prices, and infrastructure. A downward trend in the DUC count means producers are completing more wells than they are drilling.

Click here to read the full article

Source: EIA

—

Do you have any questions or thoughts about the topic? Feel free to contact us here or leave a comment below.