Ovintiv Inc. is considering a possible sale of its operations in the Uinta basin. This could fetch as much as $2 billion, people with knowledge of the matter said.

Denver-based Ovintiv is working with an adviser to gauge buyer interest in the asset. The people said they are asking not to be identified discussing confidential information.

Ovintiv’s operations in the Central basin of Utah involve drilling in about 2,600 feet of oil-saturated reservoir rock. This is according to its website. The asset could attract interest from private equity-backed energy groups, the people said.

Deliberations are in the early stages and there’s no certainty they’ll result in a transaction. A representative for Ovintiv declined to comment.

Ovintiv’s shares have fallen 12% over the last 12 months, underperforming the S&P 500 Energy Index and giving it a market value of about $11.2 billion. The company’s assets are spread across Texas, Oklahoma, Utah and Canada.

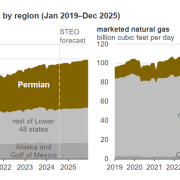

Selling its Utah assets would free up Ovintiv to focus on the Permian basin, the western hemisphere’s most productive shale fields that straddle Texas and New Mexico, where the driller last year expanded its footprint with a $4.3 billion acquisition from EnCap Investments. The company last year also completed the sale of assets in the Williston Basin of North Dakota for $825 million.

Click here to read the full article

Source: Oil&Gas 360

—

If you have any questions or thoughts about the topic, feel free to contact us here or leave a comment below.