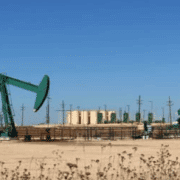

The oil rig count of active drilling rigs for oil and gas in the United States rose this week, according to new data that Baker Hughes published on Friday.

The total rig count rose by 3 to 589 this week, compared to 664 rigs this same time last year.

The number of oil rigs rose by 5 this week, after falling by a single rig in the week prior. Oil rigs now stand at 482—down by 47 compared to this time last year. The number of gas rigs fell by 2 this week to 101, a loss of 27 active gas rigs from this time last year. Miscellaneous rigs stayed the same at 6.

Crude Oil Production

Meanwhile, U.S. crude oil production stayed the same for the week ending July 19. Current weekly oil production in the United States, according to the EIA, is now on par with the all-time high of 13.3 million bpd.

Primary Vision’s Frac Spread Count, an estimate of the number of crews completing wells that are unfinished, fell sharply in the week ending July 19, from 238 to 228—the lowest levels since June 2021.

Drilling activity in the Permian fell by 1 this week at 304, a figure that is 30 fewer than this same time last year. The count in the Eagle Ford rose by 1 this week, rising to 49 after climbing by 1 rig in the week prior. Rigs in the Eagle Ford are now 5 below where they were this time last year.

Oil prices were down sharply on Friday. At 1:00 p.m. ET, the WTI benchmark was trading down $1.19 (-1.52%) on the day at $77.09. The Brent benchmark was trading down $1.29 (-1.57%) on the day at $81.08.

Click here to read the full article

Source: Oil Price

—

If you have any questions or thoughts about the topic related to oil rig count, feel free to contact us here or leave a comment below.