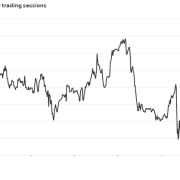

Crude oil prices saw an upward trend today, building on a significant rise the previous day following reports of Israel’s targeted killings of Hamas political leader Ismail Haniyeh in Iran and a high-ranking Hezbollah official in Lebanon.

The assassination of Haniyeh in Iran particularly heightened market concerns, prompting Tehran to issue threats of retaliation that analysts suggest could push Brent crude prices into triple-digit levels.

“We are concerned that the region may be teetering on the edge of full-scale war,” remarked Japan’s deputy representative to the United Nations, as the Security Council urged member states to intensify diplomatic efforts to resolve the escalating conflict between Israel and its neighboring countries.

China’s UN ambassador emphasized the need for influential nations to exert greater pressure and act decisively to quell the ongoing violence in Gaza.

Iran’s representative condemned the assassination of Haniyeh as an act of terrorism, as reported by Reuters amid the unfolding situation.

The Tensions in the Middle East Due to Oil Prices Rise

With tensions in the Middle East remaining elevated, Brent crude prices exceeded $81 per barrel before slightly retracting earlier today, while West Texas Intermediate approached $79 per barrel.

In further positive news for the oil market, the Energy Information Administration (EIA) disclosed that U.S. oil demand reached a seasonal high of 20.80 million barrels per day in May, a noteworthy upward revision from earlier estimates of 20 million barrels per day.

Moreover, global oil inventories are currently in decline, reflecting a significant deficit compared to historical averages, according to Eric Nuttall, senior portfolio manager at Ninepoint Partners, who spoke to Bloomberg this week. Nuttall also highlighted improvements in OPEC+ production cut compliance as a contributing factor to the optimistic outlook for oil prices.

Should diplomatic efforts fail to alleviate tensions in the Middle East, oil prices may continue to rise, driven by fundamental market dynamics and geopolitical risk factors.

Source: Oil Price

If you have any questions or thoughts about the topic related to Oil Price Rise, feel free to contact us here or leave a comment below.