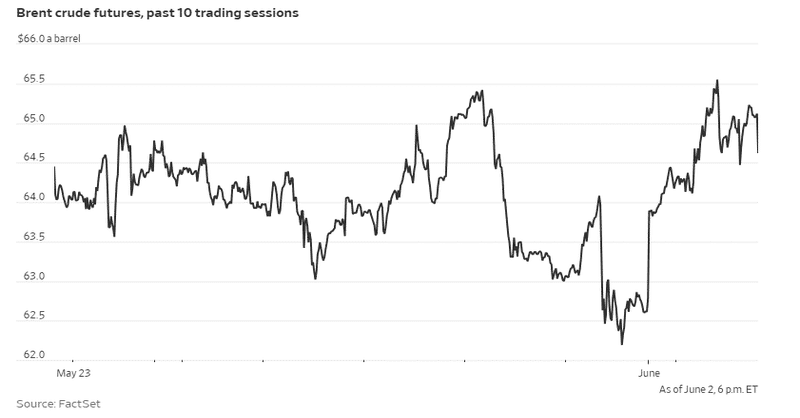

OPEC+, the cartel of oil producers, agreed over the weekend to crank up production. Instead of falling, Brent oil prices rise about 3% to start the week, at a shade under $65 a barrel.

Prices in the global energy markets are experiencing an upward surge, a trend that analysts attribute to a combination of factors, notably Ukraine’s recent drone strikes targeting military airports within Russian territory. These strategic attacks have heightened tensions and introduced a sense of unpredictability into the market, leading to concerns about the stability of Russian oil production and supply chains. Additionally, there is a concerted effort among U.S. lawmakers to further isolate Russia economically by implementing stricter measures aimed at cutting Russian oil from global markets. This push reflects a broader strategy to weaken Russia’s financial position in the ongoing conflict while simultaneously seeking to ensure that other nations align with the sanctions regime.

The Parallel Development as Oil prices rise up

In a parallel development, Russian and Ukrainian officials are scheduled to engage in talks in Istanbul today, a meeting that could potentially pave the way for diplomatic progress. However, the backdrop of escalating military actions, particularly the drone strikes, creates an atmosphere of mistrust that may undermine the prospects for a breakthrough in negotiations. The prospect of peace in Ukraine remains a complex and contentious issue, as any resolution could theoretically lead to a relaxation of the stringent Western sanctions currently imposed on Russian energy exports. Such a shift could have significant implications not only for the dynamics of the conflict but also for the global energy landscape, affecting prices and supply chains across various markets. As the situation evolves, stakeholders are closely monitoring developments, aware that the interplay between military actions and diplomatic efforts will ultimately shape the trajectory of both the conflict and the global economy.

Click here to read the full article

Source: The Wall Street Journal

—

If you have any questions or thoughts about the topic, what happens when oil prices rise? Feel free to contact us here or leave a comment below.