The information provided on this page is for general informational purposes only and does not constitute legal, financial, or investment advice. Oil and gas laws, mineral rights regulations, and royalty structures vary significantly by state and jurisdiction. While we strive to provide accurate and up-to-date information, no guarantee is made to that effect, and laws may have changed since publication.

You should consult with a licensed attorney specializing in oil and gas law in your jurisdiction, a qualified financial advisor, or other appropriate professionals before making any decisions based on this material. Neither the author nor the publisher assumes any liability for actions taken in reliance upon the information contained herein.

In oil and gas leases, there are two commonly confusing designations for measuring different things. Both net mineral acre and net royalty acre is an important part of an oil and gas lease. If you are thinking about leasing your mineral rights, knowing the definition and difference between these two terms is important in fully understanding your contract.

What is a Net Mineral Acre?

A net mineral acre (abbreviated NMA) is a term to describe a person’s percentage ownership of a larger parcel of land. Here is an illustration.

Let’s say you own ¼ mineral share of a 100-acre property. This means that you own 25 net mineral acres. If you owned the entire property, your net mineral acres would be equal to the gross mineral acres, at 100. However, most mineral leases are among several mineral rights owners.

What is a Net Royalty Acre?

A net royalty acre (NRA) is a measurement of the cash flow that you receive from the sale of oil and gas on a per-acre basis. In many oil and gas leases, a royalty percentage of about ⅛ (12.5%) was originally common for mineral rights owners, however, this has changed over time.

To calculate your NRA, first find your royalty rate and divide it by ⅛ (0.125). Let’s say that your royalty rate is 10% of the share of oil and gas sales. Here, 0.1 divided by 0.125 is equal to 0.8. From there, multiply that number by your NMA to get your total NRA. In the example above an NMA of 25 multiplied by 0.8 would equal an NRA of 20.

The Difference Between A Net Mineral and Net Royalty Acre

Net mineral and net royalty acres define by different terms. It defines an interest in land, but cannot be equated to dollars and cents. Net royalty acres are much more commonly used in mineral lease transactions because they can fully illustrate the royalty potential of a plot of land.

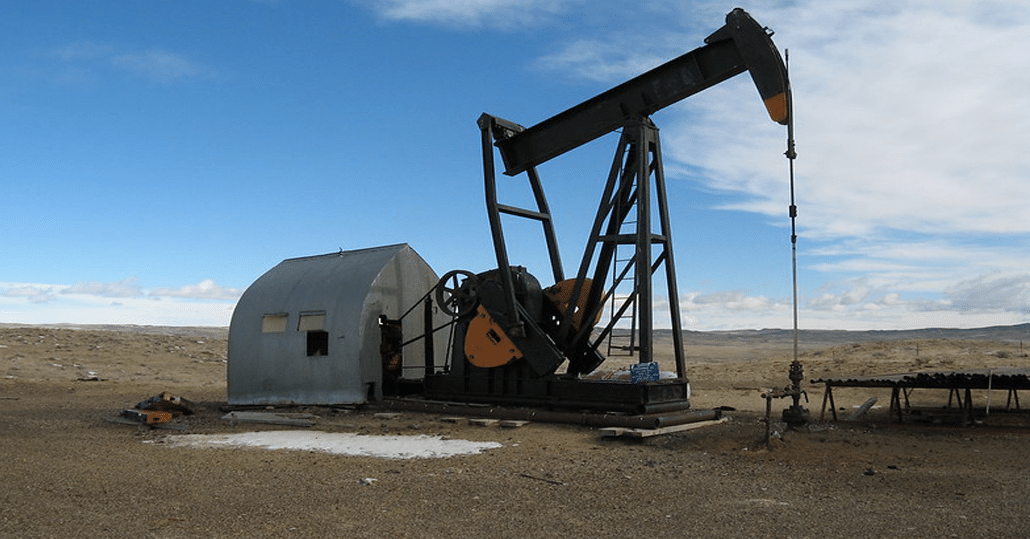

Image Credit: BLM Wyoming